What is Undebt.AI?

Use the power of artificial intelligence (AI) to easily create a debt payoff plan that's works best for your situation. Your current debts and monthly budget are automatically added by default. Add, remove or change your debt accounts to test out different "what if?" scenarios.

My favorite part of Undebt.AI is how it explains the plan in detail and in an easy to understand way. Sometimes it can be overwhelming to just have a payoff plan laid out for you. Now you can see why the debt snowball works the way it does in plain English.

Setting Up Your Debt Account Info

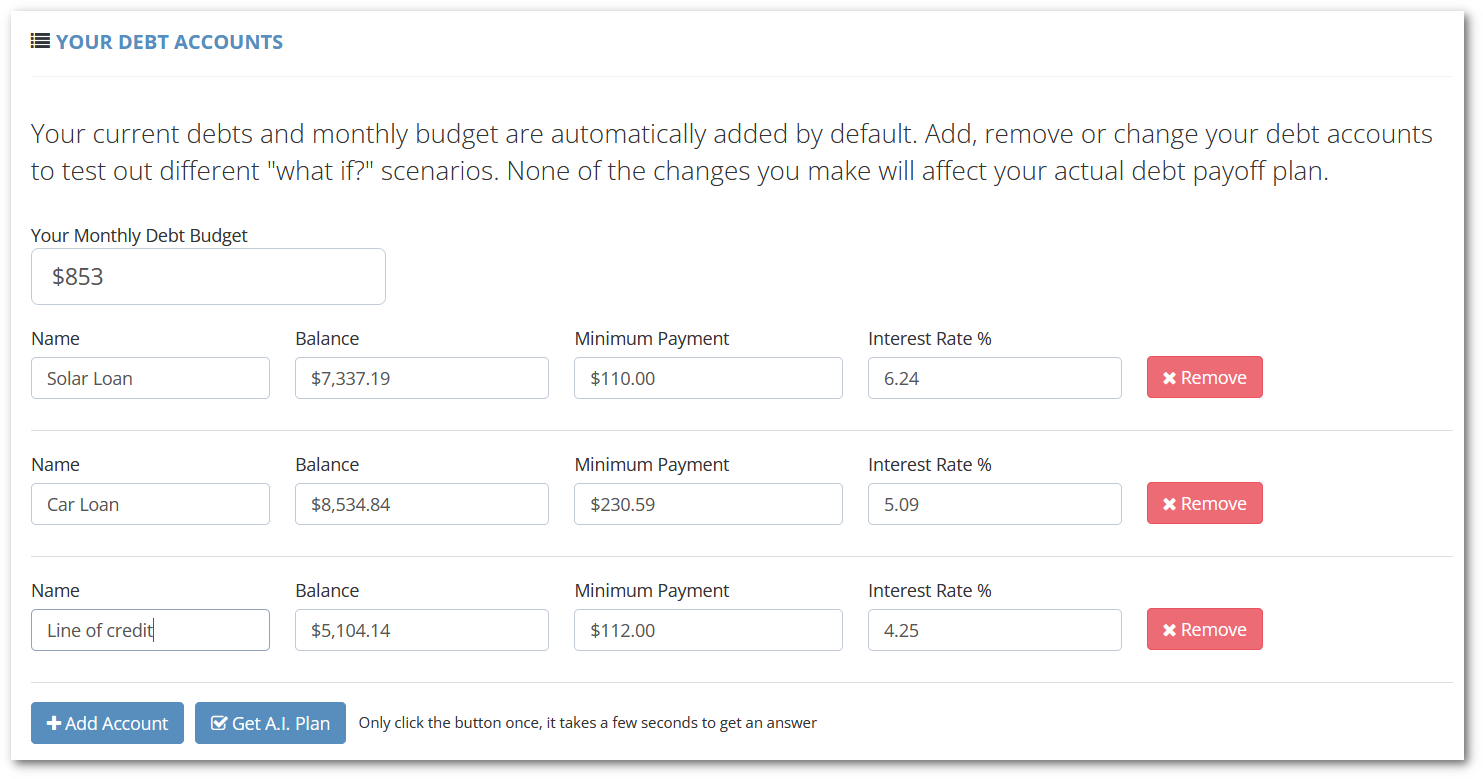

Once you've logged into your account, click on the Undebt.AI link on the left menu. By default, all of your current debt accounts will be listed along with their balance, interest rate and minimum payment due. You're welcome to change the numbers as needed. For example, if you want to see how your current payoff plan will be affected by increasing the balance of an account or lowering the interest rate, etc. Your total monthly debt budget will be brought over as well, but you can override that amount too.

Note that any changes you make aren't saved to your account; this is just for informational purposes.

Getting the AI Generated Plan

Once you have your debt information setup the way you want, click the "Get A.I. Plan" button. Be sure to just click it once; it will take a few seconds to get the plan. Here's a sample of what the output looks like:

Creating a debt payoff plan involves allocating your budget in a way that pays off the debts efficiently. There are two popular strategies for debt payoff: the avalanche method and the snowball method. - **Avalanche Method**: Focuses on paying off the debt with the highest interest rate first while making minimum payments on the other debts. - **Snowball Method**: Focuses on paying off the smallest debt first to build momentum and motivation by seeing results quicker. For this plan, I'll demonstrate both methods, using your total monthly budget of $853.00. ### Current Monthly Payments 1. **Account #1**: $110.00 at 6.24% APR 2. **Account #2**: $230.59 at 5.09% APR 3. **Account #3**: $112.00 at 4.25% APR 4. **Total Payments**: $452.59 ***Budget Surplus:*** $853.00 (total monthly budget) - $452.59 (minimum payments) = $400.41 (available to apply to one of the debts) ### Avalanche Method Plan 1. **Step 1**: Focus debt payment on Account #1 (highest interest rate) - Payment for Account #1: $110.00 + $400.41 = $510.41 - Account #2: Continue with minimum payment of $230.59 - Account #3: Continue with minimum payment of $112.00 - Total Payment: $852.41 2. **After Account #1 is paid off**, redirect your focus to Account #2. 3. **After Account #2 is paid off**, allocate all payments to Account #3. ### Snowball Method Plan 1. **Step 1**: Focus on Account #3 (smallest balance) - Payment for Account #3: $112.00 + $400.41 = $512.41 - Account #1: Continue with minimum payment of $110.00 - Account #2: Continue with minimum payment of $230.59 - Total Payment: $852.41 2. **After Account #3 is paid off**, redirect your focus to Account #1. 3. **Continue**: Once Account #1 is paid off, allocate all payments to Account #2. ### Considerations - **Avalanche Method**: Saves more money on interest over time due to focusing on the highest interest rate first. - **Snowball Method**: Provides quicker victories by paying off the smallest debt first, which can increase motivation. ### Execution Tips 1. **Automation**: Set up automatic payments to ensure consistency. 2. **Increase Payments**: If any additional funds become available, such as bonuses or tax refunds, consider applying them towards debt. 3. **Review Regularly**: Re-evaluate your budget and debts every few months to see if adjustments are needed based on interest rates, balances, or financial changes. Choose the method that best fits your financial and motivational needs. Once a debt is eliminated, roll that monthly payment into the next debt, accelerating the payoff process.

How To Get Access To Undebt.AI

Undebt.AI is part of the Undebt.it+ suite of premium content pages. You can sign up for a free 30 day trial if you want to check it out - no credit card or prepayment is required. Be sure to check for promo codes to get a deal on the (already low!) annual cost.