Cash Flow Index (CFI) Debt Payoff Method

Paying off debt is less about skipping lattes and more about coming up with a focused strategy to pay it off quickly. While there are multiple debt payoff methods, the two most popular are the debt snowball and the debt avalanche.

But another debt payoff option has emerged. The Cash Flow Index (CFI) method focuses on freeing up your monthly cash flow by paying off your most inefficient debt first.

We’ll cover the details of how to calculate the CFI of each of your debts and organize an efficient debt payoff plan with the Cash Flow Index.

What is the Cash Flow Index Debt Payoff Method?

The Cash Flow Index payoff method is a way to identify the debts that have the most impact on your cash flow. Then, you pay these debts off first. Prioritizing these debts lets you cut down on your required monthly payments and frees up cash in the process.

While other debt payoff methods focus on your total balance or interest rate, the CFI focuses exclusively on your monthly payment compared to the balance of the loan.

Note: Before you pay off your debts using the CFI method, make sure to save up an emergency fund of up to 3 months of expenses. This will help prevent you from slipping back into debt if a financial emergency arises.

How Is the CFI Calculated?

The calculation is simple. You only need to put in the current loan balance and the monthly payment amount.

Here’s the calculation:

Cash Flow Index = Loan Balance / Monthly Payment

The higher the number, the more “efficient” the loan is. A lower number indicates a lower efficiency loan. In a CFI payoff plan, the lowest CFI index debts get paid off first.

It may sound confusing, but this calculation is a simple way to organize your debt.

How to Pay Off Debt With The Cash Flow Index

So how exactly does the CFI method work? Let’s consider this example:

| Debt | Balance | Minimum Payment | Interest Rate | CFI Score (Payment / Balance) |

| Visa | $7,000 | $280 | 19% | 50 |

| Student Loan | $37,000 | $410 | 6% | 90 |

| Auto Loan | $17,000 | $350 | 5% | 49 |

| Mortgage | $277,000 | $1,400 | 4% | 198 |

The debts with a lower CFI score are deemed “inefficient” and should provide the greatest return on your debt payoff by freeing up the most cash flow.

If we organize the above debts in order from lowest CFI to highest, it looks like this:

| Debt | Balance | Minimum Payment | Interest Rate | CFI Score (Payment / Balance) |

| Auto Loan | $17,000 | $350 | 5% | 49 |

| Visa | $7,000 | $140 | 19% | 50 |

| Student Loan | $37,000 | $410 | 6% | 90 |

| Mortgage | $277,000 | $1,400 | 4% | 198 |

While the most popular debt payoff methods would focus on paying off the credit card first (lowest balance, highest interest rate), the CFI method shows that it is more efficient than the auto loan. Repaying the auto loan first will free up much more cash flow compared to the other debts.

The higher CFI debts are saved for last since they don’t take up as much monthly cash flow compared to their total balance.

Ranking Your Cash Flow Index Scores

The CFI is a simple way to focus on getting more money into your budget each month. But what exactly does each number represent, and should you pay off all these debts before investing?

Here’s how to rank your debts based on their CFI score.

| CFI Score | What To Do |

| 0 – 49 | Pay off first |

| 50 – 100 | Consider debt restructure |

| 100+ | Do not prioritize payoff |

According to the Cash Flow Index Method, if your CFI score is below 50, the debt is taking up too much cash flow and should be paid off quickly. Debts with a score between 50 and 100 are somewhat inefficient but may benefit from a refinance or negotiated to a lower interest rate.

If the CFI score is above 100, this debt is deemed cash flow efficient. As a result, it should not be paid off early.

The Rate of Return on Your Debt

Another way to calculate the efficiency of your debt is to look at your debt payoff as an investment. You can calculate the rate of return on your debt by multiplying your minimum payment by 12, then dividing by your total loan balance.

For example:

| Debt | Balance | Minimum Payment | Interest Rate | Rate of Return |

| Auto Loan | $17,000 | $350 | 5% | 25% |

| Visa | $7,000 | $140 | 19% | 24% |

| Student Loan | $37,000 | $410 | 6% | 13% |

| Mortgage | $277,000 | $1,400 | 4% | 6% |

As you can see, paying off your auto loan in a single lump sum is equivalent to a 25% return on your debt payoff “investment” in regards to freeing up your cash flow.

Where the Cash Flow Index Method Shines

The CFI method is great for freeing up monthly cash flow, especially for those with debt that has been around for a while.

For example, if you have had your auto loan for a few years, your balance may be lower. However, your payment is still just as high as when you took out the loan. Using the CFI, this would be seen as inefficient debt since paying off your auto loan would free up cash quicker.

It also works well for understanding which of your debts are benefitting your cash flow. Yes, getting out of debt is the ultimate goal, but knowing that your mortgage or other low-payment debt is helping you keep more cash on hand can help you prioritize paying off other debts first.

Where the Cash Flow Index Method Falls Short

The CFI method is not always the best plan for paying off your debts. Since it ignores interest rates, it may cost you more in the long run.

For example, if you have a credit card or auto loan with a 0% interest rate and higher monthly payments, the CFI would deem these debts inefficient and prioritize their payoff. This would mean paying much more in interest on other debts while focusing on paying off a debt with no interest.

| Debt | Balance | Minimum Payment | Interest Rate | CFI Score (Payment / Balance) |

| Auto Loan | $17,000 | $350 | 0% | 49 |

| Visa | $7,000 | $140 | 19% | 50 |

| Student Loan | $37,000 | $410 | 6% | 90 |

| Mortgage | $277,000 | $1,400 | 4% | 198 |

From our earlier example, would you rather pay off a $17,000 debt with a 0% interest rate or a $7,000 debt with a high interest rate? According to CFI, you would still focus on the auto loan, regardless of the interest rate.

Also, when comparing the “rate of return” on your debt payoff, the CFI assumes you could pay off your debt in a single lump sum. This is not a reality for most of us who are trying to pay off debt, so the calculation doesn’t really hold any weight.

While the CFI can be a great way to see how quickly you can free up cash flow, always consider all the variables of your debt before determining your debt payoff plan.

Cash Flow Index vs. Other Debt Payoff Methods

The Cash Flow Index takes an interesting approach to debt payoff, but how does it compare to the debt snowball and the debt avalanche methods?

All three debt payoff methods are designed to help you focus on one debt at a time. The idea is to only pay the minimum payment on every debt while throwing every extra dollar you have at the single “worst” debt.

Both the Cash Flow Index and debt snowball ignore interest rates when paying off your debt. While the debt snowball organizes your debt from smallest balance to largest, the CFI focuses on freeing up more cash flow and ranks your debt based on their minimum payment and total balance.

The debt avalanche focuses on paying off high-interest debts first, but this may sacrifice monthly cash flow to pay off larger debts first, even if they have a low minimum payment.

Side by Side Comparison of Each Payoff Method

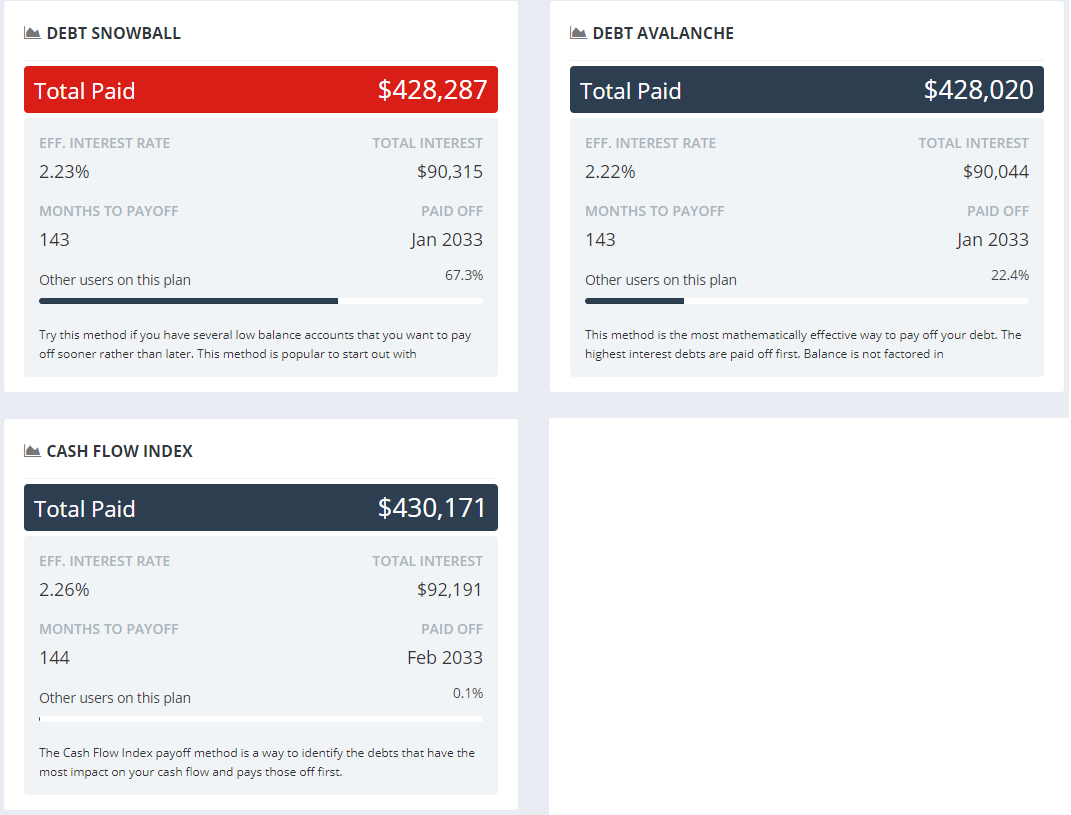

While all of these methods have their strengths and weaknesses, let’s look at the bottom line and compare which method helps you pay off debt the quickest while saving the most money.

Using our same debts from above, here’s how the total payoff looks with each method:

| Debt | Balance | Minimum Payment | Interest Rate |

| Auto Loan | $17,000 | $350 | 5% |

| Visa | $7,000 | $140 | 19% |

| Student Loan | $37,000 | $410 | 6% |

| Mortgage | $277,000 | $1,400 | 4% |

As you can see, both the Debt Snowball and Debt Avalanche are very similar, with $428,000 total debt paid, about $90,000 in total interest, and 143 months to be completely debt-free.

In comparison, the Cash Flow Index Method pays a total of $430,000 in total debt, about $92,000 in interest, and takes 144 months to pay off.

All three of these methods offer a solid strategy for paying off your debt. Considering that some of these debts can be restructured to save on interest, all of these debt payoff strategies will get you across the debt freedom finish line.

Related: The 7 Undebt.it Payoff Plans

Using the Cash Flow Index Plan on Undebt.it

It’s easy to try out the CFI plan on Undebt.it. Choose it from the list of payoff plans and see how it works for you compared to the other debt repayment options.

This plan is available on both the free and Undebt.it+ accounts.

If you haven’t already, sign up for your free Undebt.it account and calculate how quickly you can become debt-free today!