How to Pay Down a Debt with Weekly Payments

Background

I have been dealing with a unique way to pay down a debt using weekly payments and I wanted to write up an article in case others are in the same situation. Sometimes if I have a large expense that I can’t pay off immediately, I will put it on a credit card and then do a balance transfer after the first month. I don’t want to carry a credit card balance, so I want to pay it off as soon as possible.

Normally, you would just determine your monthly payment and just pay it once a month like a normal expense but I’m going to handle this one a little differently by paying it down in weekly increments of $100.

2 Advantages To Paying Down Debt Using Weekly Payments

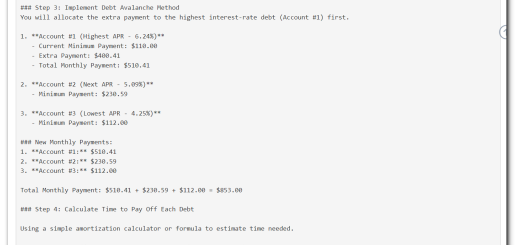

There are a couple of advantages to this method. First, you’re saving interest by paying it down every week. This is the same logic of the bi-weekly mortgage payments; each payment lowers your balance and therefore accrues less interest. Secondly, it’s easier for me to make 4 (or 5 depending on the month) $100 weekly payments than one $400 payment each month. I find that if people are having a hard time coming up with a large payment, they will be more inclined to skip the snowball amount altogether and just pay the minimum.

Using Balance Transfers To Your Advantage

I use the credit card float as in interest free loan and then transfer it out before the interest kicks in. The float is the time between the purchase and when the purchase actually starts accruing interest.

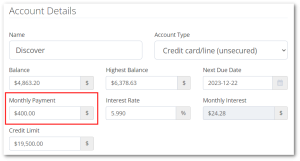

I like to use my Discover account for balance transfers for a few reasons. They make it really easy to pay off credit cards from other lenders; all you need to provide is the payoff amount and the credit card number. Also, they usually have two options for balance transfers: 0% interest for a year (with a balance 4% transfer fee) or 5.99% for a year with no fee. Another reason I use Discover for balance transfers is that it’s my oldest credit card account and I want to make sure it stays open for credit score purposes. I don’t ever use my Discover card anymore, so this is a great way to keep it open.

Keep in mind these transfer options change all the time. I just checked the current Discover offers and now both options have the 4% fee. I think the offers depend on the economy in general as well as the individual user.

How To Setup The Debt Account on Undebt.it

For a regular credit card debt account, you would just use the minimum payment that the lender tells you. However, I am going to use my total monthly payment goal for the account which is $400

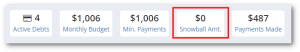

The $400 amount I am planning on paying is the total debt snowball amount I am paying, so in the header tile, I see my snowball amount set to $0. This is just a way to force the system to use all of the snowball amount on this one debt.

Dealing With Weekly Payments

Undebt.it was built to use monthly payment buckets, so we need to go through an extra step if we want to use weekly payments. Whenever you record a payment on Undebt.it that is equal to or greater than the minimum payment due, the site will automatically bump up the due date a month. The benefit of setting a high monthly payment like on this account, is that I don’t have to deal with the automatic due date payment bumps.

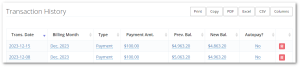

I’m going to be making payments every Friday, so here’s how the transaction history looks for this account. Notice how I am using the same “billing month” for the payments. This is important because that’s how the site groups the payments together.

I am recording these payments manually, so that’s my I have autopay turned off. Now, let’s take a look at the debt snowball table page to see our payoff plan:

You can see the planned total payment is $400 and I have already made two of the $100 payments shown in blue. The $200 in black refers to the remaining amount scheduled to be paid this month. Notice how the “snowball amount” column is basically zero. That just means we are forcing all of the extra money into the minimum payment instead of having the site calculate the snowball amount for us. After you make the fourth payment, the due date for the account should get automatically bumped up to the next month.

Can you please add the ability to add comments to payments? If that feature were locked behind a paywall, for that reason alone, I would get Undebt.it+.