FAQ Articles For Basic Site Functions

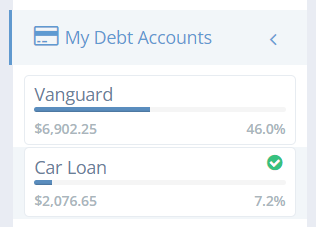

What does the green check mark mean?

Created November 16, 2022 - 36,486 ViewsThe green check mark in the My Debt Accounts side menu means that the debt account has met the monthly payoff goal and is done until next month.

How do I change the debt snowball amount?

Created March 10, 2021 - 35,968 ViewsThe debt snowball amount is not something you can change directly; it's a calculated amount. The snowball amount is the difference between your total budget amount minus the sum of your minimum payments. For example, if your total budget is $1,000 and the you have 2 credit cards with a $200 payment ...read more

What does "Quick Pay" mean?

Created March 18, 2021 - 34,725 ViewsThe debt account tiles on the Dashboard page have a button labeled "Quick Pay". This is just a fast way to record a payment versus going into the Debt Details page and doing a manual transaction. When doing a Quick Pay transaction, the payment amount and payment date are what is used on the transact...read more

What does the asterisk next to the dollar amount mean?

Created March 18, 2021 - 31,417 ViewsOn the Dashboard & Snowball Table pages, you may see an asterisk (*) next to the dollar amount. The asterisk means that at least one payment has been made for the current month and this is the remainder of the amount scheduled to be paid.

Can I track my home mortgage on Undebt.it?

Created March 9, 2021 - 30,974 ViewsYes, you can keep track of your home mortgage. When you setup the debt account, make sure to choose Mortgage as the account type. Once you change the account type to mortgage, there will be an additional field labeled Escrow, Taxes & Insurance available. Use the principal payment amount as the Month...read more

I have a student loan that's not due for another six months.

Created February 17, 2021 - 29,371 ViewsUndebt.it supports deferred due dates, so just add it in like any other debt account and choose the actual due date. Check out the Debt Snowball Table and you'll notice that there won't be any payments due on your student loan until the month when the payments are scheduled to kick in. One thing to ...read more

The amounts the plan is wanting me to pay are very high

Created February 17, 2021 - 26,859 ViewsIt sounds like you either have your monthly budget set too high *or* you are joining mid way through a billing cycle and you have already paid some of your debt accounts for the month. Undebt.it will try and use all of your budget each month to pay down debt and if you have just created an account, ...read more

Difference between the 'balance' and 'highest balance'

Created February 17, 2021 - 26,138 ViewsThe "balance" field refers to your current statement balance. The "highest balance" can be your current balance too if you're just getting started. It can also be used to track existing payoff progress before signing up on the site. For example, let's say you have a credit card with a current balanc...read more

What exactly does "billing month" refer to?

Created February 17, 2021 - 23,864 ViewsYou'll see the term "billing month" on the debt details page. It refers to the month in which the payment is due. It's possible that a payment is made at the end of the month, but the account's due date is in the following month. For example, if you have a debt that's due on June 6, the billing mont...read more

How can I exclude a debt account from the payment plan?

Created February 17, 2021 - 21,167 ViewsYes. Go to the Debt Details page for the debt account and uncheck the box labeled Include in payoff plan?. When you go to the Debt List page, you'll notice that the account will be labeled excluded. You can also go to the Account List page and click on the button in the Status column....read more

How do I remove a debt account?

Created February 17, 2021 - 20,808 ViewsGo to the Debt Details page for the account (click on the account name on the Account List page). There is a "Delete Account" button at the bottom of the page.

How do I change the debt payoff method?

Created February 17, 2021 - 20,307 ViewsYou can change the payoff debt method in two different places. When you choose a new plan, everything is updated automatically for you and you can change it back any time you like. The first location you can find it is on the "My Account" page. The other place is on the "Debt Snowball Table" page...read more

How do I print or export my information?

Created October 18, 2022 - 19,829 ViewsMost of the information tables on the site have export/print buttons at the top. For example, if you would like to print or export your account information, go to the Account List page and use the buttons at the top of the list. You can use the "Columns" button to select which columns to add or remo...read more

I signed up for an account and added my debt info. What now?

Created February 17, 2021 - 18,043 ViewsThe two places you'll be spending the most time are the Debt Dashboard and the Snowball Table page. The Dashboard is where you can keep track of your current accounts and record payments. The Snowball Table page shows you your entire payment plan from start to finish; it's like what you see on the D...read more

How do I add a new debt account?

Created February 17, 2021 - 18,035 ViewsGo to My Debts > Debt List and scroll down to the bottom to the "Add New Debt Account" section. You can setup as many debt accounts as you like.

How do I add more debt accounts?

Created February 17, 2021 - 17,580 ViewsGo to the Debt List page. This page shows a list of all of your debt accounts and there is a form at the bottom for adding new accounts. Click on the name of the account in the list to get to the Debt Details page of the account. There is also a link to add new accounts on the left sidebar in the My...read more

The payment amount is not showing up in blue

Created November 16, 2022 - 15,410 ViewsThe amount shown in blue text on the Debt Snowball Table page is the amount that has been paid on the debt in the current billing month. In the example below, the $459 payment on the auto loan is the full amount that was scheduled to paid, therefore there is nothing more that needs to be paid on tha...read more

I paid off a loan but it's still on the snowball table

Created November 26, 2025 - 388 ViewsThis is by design. The loan will show up on the snowball table for the remainder of the month. Once the next month comes around, the account will fall off of the list. This keeps the payoff plan accurate for the current month. Use the "next month" button on the snowball table to see what the plan lo...read more