How do I handle promo interest rates?

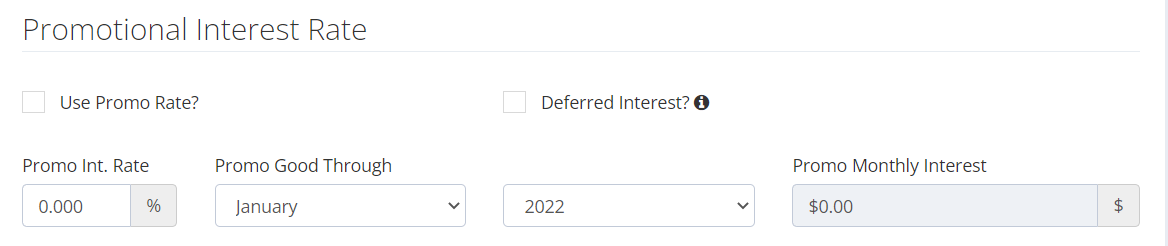

You can assign promotional interest rates to accounts on the Debt Details page in the Promotional Interest Rate section. Set the promo rate and the expiration month. The Use Promo Rate? check box turns the rate off and on, however, you don't need to turn the promo rate off when it expires. The Promo Monthly Interest field shows you how much interest you will be paying

One important thing to note is the Deferred Interest option. This lets you flag an account as having deferred interest and will automatically put it at the top of the list to be paid off. It's important to know the difference between deferred interest accounts and debt account is deferral. An interest deferred account in this case is one where you are responsible for all of the accrued interest if you don't totally pay the account down. For example, appliance stores will often sell you something with "zero percent interest for a year". If you don't pay off the total amount of the loan, you will have to pay off all of the interest that accrued over the course of the year; and the default interest rate on the loans are almost always very high.

One other important thing to note is that the promo rate will apply to the whole balance of the account. I am planning on adding support for multiple interest rates in the future.

Keywords

zero percent, 0%, promo rate, promotion, interest, promotional balance