The 7 Undebt.it Payoff Plans

Are you looking for a tool to help you tackle your debt? A debt payoff plan can be a useful way to strategize how you will eliminate your debt.

Undebt.it offers seven different payoff plans, including the debt snowball, debt avalanche, debt hybrid, and more. Each strategy can help you eliminate your debt in a way that aligns with your financial priorities.

Undebt.it Payoff Plans to Eliminate Debt

Before you dive into any particular debt repayment plan, take a minute to explore the seven Undebt.it debt payoff strategies. Finding the plan that works for you can help you successfully eliminate your debt.

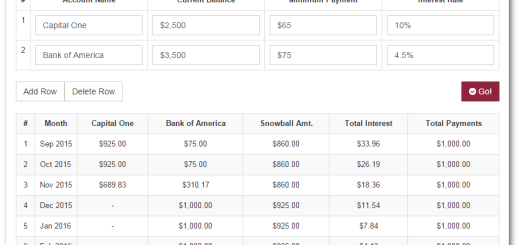

1. Debt Snowball

You can use the debt snowball strategy to eliminate your debts by paying off your smallest debt first. While you pay the minimums on all your debts, you put any extra money towards your smallest debt until it’s paid off.

From there, you’ll tackle the next largest debt until you eliminate all of your debts.

The benefit of the debt snowball is that you can build on the momentum of small victories. With each debt you eliminate, you’ll feel the accomplishment and confidence that comes with eliminating an outstanding debt from your books.

In addition to your debt snowball, you may need to include debt snowflakes in your plan. A debt snowflake is a one-time or extra payment that you include in your debt snowball. Debt snowflakes can have a big impact on your repayment timeline.

With Undebt.it, you can easily include debt snowflakes. Whether you have a tax refund or bonus check coming your way, you can include it in your Undebt.it plan.

You can also add negative snowflakes to your plan. For example, you might have an expected car repair that you need to fund with some of your debt snowball. Including these negative snowflakes gives you an accurate repayment timeline.

Related: What is the debt snowball?

2. Debt Avalanche

The debt avalanche is another popular debt repayment strategy. You might also hear the debt avalanche referred to as “debt stacking.”

With the debt avalanche, you tackle the debt with the highest interest rate first. This is the most efficient way of paying down your debts while minimizing your interest payments.

The drawback to the debt avalanche is that you might find it challenging to maintain your motivation without small wins along the way. However, you will reach your goal of becoming debt-free faster.

Related: Debt snowball vs. avalanche: How to figure out which debt payoff method is the best?

3. Debt Hybrid

The debt hybrid method is a unique solution that combines the benefits of the debt snowball and the debt avalanche. When you bring the best qualities of these repayment methods together, you’ll repay your debt quickly while maintaining your motivation.

The debt hybrid approach is based on the idea of minimizing your interest payments while maximizing your small victories along the way. However, finding the right balance can be tricky.

Luckily, you won’t have to run the numbers to find the perfect balance of these two elements on your own. Instead, you can explore what the debt hybrid plan has to offer with Undebt.it.

You won’t find a debt payoff calculator quite like this debt hybrid approach anywhere else on the internet.

Related: What is the Debt Hybrid Payoff Method?

4. Highest Monthly Payment

When you are paying down debt, you might feel trapped by a tight monthly budget. Although the ultimate goal of paying down your debt is to help you attain financial freedom, you can opt to maximize your budget freedom earlier in the payoff process.

Imagine how your budget could change if you eliminate the highest monthly payment from your budget. By taking action to eliminate the highest monthly payments, you’ll find more flexibility in your budget quickly.

If you want to prioritize cash flow flexibility, then targeting the highest monthly payment is a good option.

Related: Cash Flow Index (CFI) Debt Payoff Method

5. Credit Utilization

Everyone has a different reason to pay down debt. If you are hoping to improve your credit score quickly, then focusing on your credit utilization can have a big impact.

Your credit utilization rate composes a large part of your credit score. As a result, you can improve your credit score by paying down debts that will lower your credit utilization.

With this strategy, you’ll focus on debts that are closest to their maximum credit limit. Depending on your outstanding debts, this could be a useful strategy to boost your credit score.

Keep in mind that you may only feel rewarded if you have a particular reason for boosting your credit score.

Related: Credit Score Jumpstart Project

6. Highest Monthly Interest Paid

As you pay down your debts, you will likely get tired of paying for interest. After all, money spent on interest payments is not helpful for your long-term financial goals.

In this plan, you’ll follow a similar strategy to the avalanche method. But, instead of paying down the loan with the highest interest rate first, you’ll pay down the loan with the highest monthly interest payment attached to it.

By focusing on the dollar amount of the interest paid, you’ll be able to further eliminate needless interest payments. If you want to stop making large interest payments, then this strategy could be the right move.

While you might not see small wins along the way, the numbers behind this strategy can be very motivating. If you can trust yourself to follow the numbers, then this strategy is a good option.

Related: Undebt.it Tips & Tricks

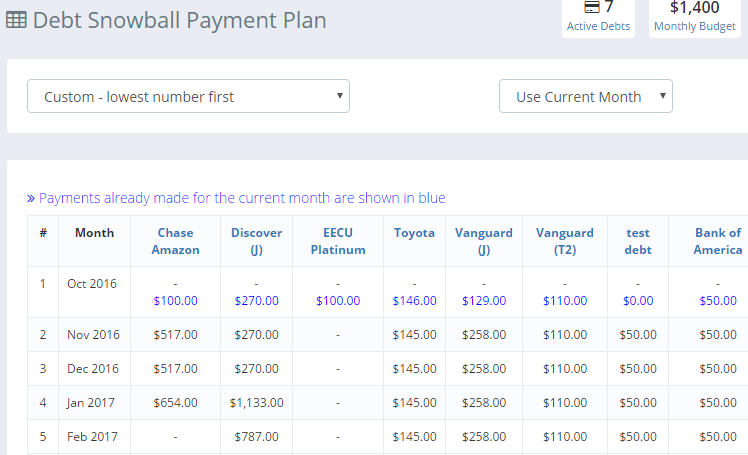

7. Custom plans

The final debt payoff plan offered by Undebt.it is the custom plan. You can create a custom plan that is tailored to meet your unique financial needs.

With the custom plan, you can adjust your strategy to reflect the payoff order that works for you by choosing which debt you want to pay first. With the ability to fine-tune your payoff order, you’ll be in complete control with a custom plan.

Like all of the debt payoff plans, it is free to explore your custom plan options with Undebt.it. However, you will need to upgrade to an Undebt.it+ membership if you want to use the drag and drop custom plan creator.

With your unique financial goals in mind, you can create a custom debt payoff plan that motivates you and is a perfect match for your unique situation.

Related: New Undebt.it+ feature: Printable payoff tables

Which Debt Payoff Plan is Right for You?

As you explore your debt payoff options, you’ll likely realize that choosing between seven strategies is difficult.

However, it is a good idea to explore each of the options before committing to a particular debt repayment strategy. Without the right plan in place, you could find yourself lacking motivation or missing out on the opportunity to save on interest payments.

Fortunately, you can easily compare your options with the help of a free Undebt.it account. Once you create an account, you can explore how each strategy could help you repay your debt.

After a little bit of exploration, you’ll likely find the right strategy to suit your financial goals. For example, if you know that you will be motivated by small wins along the way, then the debt snowball method is a good choice. Or you might decide to align your debt repayment strategy with another goal, such as adding more flexibility to your budget or boosting your credit score.

No matter what your reasons are for paying down your debt, you’ll find a practical debt payoff strategy with the help of Undebt.it.

Related: 7 effective ways to pay off debt fast

Summary

If you want to eliminate your debt, take advantage of the free tools offered by Undebt.it. You can explore your debt payoff strategies and determine which course of action is best for your situation.

With the power of Undebt.it to help you tackle your repayment journey, you’ll be in for a smoother ride. Take a minute to sign up for a free Undebt.it account today.

Would Undebt.it consider adding an 8th method, cash flow index (CFI) ?

You calculate the CFI for each debt simply by this formula: (Remaining Debt / Minimum Monthly Payment).

You then prioritize extra payments toward the debt with the lowest CFI. Once the lowest CFI debt is paid off, the newly available monthly cash flow should be used toward paying off the next lowest CFI debt, and so on.

The idea behind this method is that it is the fastest way to free up cash flow, just in case it is needed if an emergency or change of circumstances comes up.

Sure, good idea. Thanks

https://undebt.it/blog/cash-flow-index-cfi-debt-payoff-method/