7 Effective Ways to Pay Off Debt Fast

Debt can feel like a crushing weight that won’t go away, but it is possible to pay off debt fast without getting a raise or winning the lottery.

Paying off your debt fast starts with a commitment to stop using debt and requires an almost obsessive focus on tackling one debt at a time. Funnel as much money as possible toward your debt, stick to your budget, and watch the debt melt away!

But how can you start doing that today?

Here are the seven most effective ways to pay off your debt fast.

1. Stop Using Credit Cards

If you want your debt gone, you need to make a hard commitment to stop using your credit cards. Now, that sounds simple, but there are a few things you need to do to make sure you don’t fall back into the trap of credit cards.

Cut Up Your Credit Cards or Put Them on “Ice”

One of the best ways to get rid of your credit cards is to physically cut them up and recycle them. Don’t worry, this won’t affect your account, but it WILL stop you from using your credit card for your daily spending.

If you aren’t comfortable destroying your credit cards, another trick is to literally “freeze” your credit cards. Simply fill a 1-gallon zip-lock baggie halfway with water, drop your cards in there, and stick it in the freezer.

The goal here is to remove the temptation to use your cards so you don’t go further into debt while focusing on paying them off.

Change Payments and Online Shopping to Debit Card

After removing access to the cards, you will also need to remove your credit card information from any automatic payments or online shopping site.

Yes, even Amazon.

Start with your monthly bills (utilities, subscriptions, etc.) and replace the payment information with your debit card or bank account.

Next, go through any online shopping sites you use and remove the credit card information and replace it with your debit card.

Finally, remove your credit card information from any app on your phone that you can make purchases through (yes, even Candy Crush), and replace with your debit card. This goes for Apple Pay, Google Pay and any other payment platform you have an account with.

This may take some time, but will completely remove your ability to go further into debt with credit cards.

2. Cut Spending Quickly with a Bare-Bones Budget

Once you remove access to spending with credit cards, it’s time to review your spending and make some adjustments.

You are going to cut out things that don’t move you toward your debt payoff goal.

First, you need to create a budget.

Start with your income at the top, add in your bills, and input your daily spending (things like groceries, gas, and shopping). Once you have a budget in place, it’s time to start cutting expenses.

Needs vs. Wants Analysis

The easiest way to cut your spending is to simply go through every category in your budget and ask yourself “do I REALLY need this?”

Want a quick shortcut?

Here are the four main categories you need to cover your “bare-bones” expenses.

- Food

- Housing

- Utilities

- Transportation

Anything outside of those categories are usually “wants” and can be put off or completely cut out while you are paying off your debt. This will optimize your debt payoff and get you there MUCH quicker.

Related: 25 Best Google Sheets Expense Tracker Templates

3. Lower Your Monthly Bills

Once you’ve cut out the spending you don’t need in your budget, it’s time to start lowering your fixed expenses.

If you’d like to start getting a better handle on your non-debt recurring bills, such as utilities, cell phone, or Netflix, you can use the Undebt.it Bill Management Feature. It will send text reminders when bills are due, automatically record your payments, and keep a history of your bill payments. It also puts them on the calendar along with your debt payments so you have a clear view of what is due when.

Find out more about the Bill Management feature here.

Here are a few quick tips to help you save money on your monthly bills.

Find Lower Rates on Utilities

The quickest way to lower your utility bills is to simply call them and ask if they have any promotional rates or discounts available. If not, ask if there are any other packages available, maybe ones with fewer features to save you a few dollars each month.

If they can’t find any discounts for you, find a competing service (if available) and find out what their rates are. Call them and let them know you are considering switching, but you need them to give you a rate worth switching for.

Negotiate Lower Rates for Internet & Cell Phone

Most internet and cell phone plans have “new customer” offers and can save you a significant amount of money. Shop competitors for the features you want and find the biggest discount available for that service.

If you enjoy your current service, simply call your internet or cell phone provider and let them know about their competition’s current offer. Ask them to match it to keep you as a customer.

No matter what service you are paying for, remember, everything is negotiable.

4. Lower Your Debt Interest Rates

In addition to negotiating your fixed monthly expenses, you can lower the interest rates on your debt, saving you serious money in the long run. Every dollar you don’t pay in interest is a dollar that can go towards reducing your debt.

Here are a few ways to do this:

Call Credit Card Companies to Lower Interest Rates

If you have credit card debt, call each credit card company and simply ask them if they can lower your interest rate. As long as your account is in good standing and you have a strong credit score, they should be willing to work with you and lower your rate.

If they don’t immediately agree, bring up a few competing credit card rates and let them know you don’t want to switch but are considering it if you can’t get a better rate.

Consider a Balance Transfer

If you can’t lower your rate on your current cards, consider a balance transfer. Many cards offer 18-24 months of 0% interest when transferring your current credit card balance, which can significantly lower your monthly payment and save you a TON in interest.

To do this, find a 0% card that fits your needs, apply, and set up a balance transfer from your current card. Be aware of any fees associated with the transfer and see if you can get them waived. And remember, the 0% interest is typically only for a limited amount of time, so have a debt payoff plan in place to pay off the balance before the introductory rate expires.

Consider a Student Loan Refinance

If you have private student loans with a higher interest rate, consider doing a student loan refinance. This can help you lower your monthly payment and save you thousands in interest over the life of your loan.

There are many student loan refinancing options available. Find one that fits your financial position and credit score to see what your rates might be.

Note: For most circumstances, you do NOT want to refinance your federal student loans. These loans offer additional benefits provided by the government (including forbearance and forgiveness) and if you refinance them with a private lender, you lose these benefits.

5. Use The Debt Snowball or Debt Avalanche With Undebt.it

The two most popular debt payoff methods are the debt snowball and the debt avalanche. Here at Undebt.it we have a free snowball calculator that will generate an easy-to-follow plan. It actually has 7 different methods — including the snowball and the avalanche.

Here’s a quick breakdown of how they work.

How The Debt Snowball Works

The Debt Snowball is perhaps the most popular debt payoff method thanks to financial guru Dave Ramsey. It’s a simple concept:

- List your current debts by balance, from smallest to largest.

- Pay only the minimum payment on all the largest balances.

- Pay off the smallest balance debt first.

- Once that debt is paid off, take that payment and apply it to the next smallest debt.

- Do this until all your debt is paid off.

The Debt Snowball ignores the interest rates on your debt and instead focuses on “quick wins” by paying off the lower balance debts first. This helps you build momentum and start knocking out your debts quickly.

Related: What Is the Debt Snowball?

How The Debt Avalanche Works

The Debt Avalanche has you list your debts by interest rate, from highest to lowest. You simply pay off the highest interest debt first, ensuring that you are paying the least amount of interest on your debt payoff journey.

After paying off the highest interest debt, you take your payment and apply it to the next-highest-interest debt, and so on until you are debt free.

Related: What Is the Debt Avalanche?

Debt Snowball vs. Avalanche – Which is Better?

The Debt Snowball is great for people who need to get motivated to pay off their debt. It focuses on the psychology of “quick wins” and helps keep you motivated by rolling your payments into bigger and bigger amounts as each debt is paid off.

The Debt Avalanche is great for people who want the most cost-effective way to pay off debt. It focuses on paying off the most damaging debt first and lets you pay the least amount of interest over time.

Neither method is necessarily better than the other, it’s all about what will help you start and stick with your debt payoff commitment.

Related: Debt Snowball vs. Debt Avalanche: How to Figure Out Which Debt Payoff Method is Best?

Using the Undebt.it App To Pay Off Debt Faster

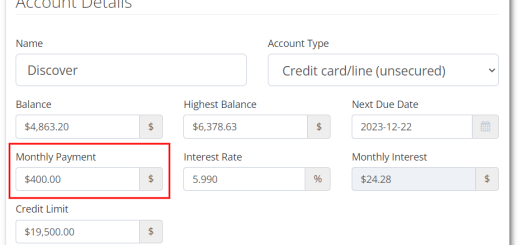

Luckily, the Undebt.it app gives you access to both the Debt Snowball and Debt Avalanche methods of paying off your debt (as well as custom debt payoff plans). Here’s how it works:

- Create a free Undebt.it account

- Add your debt information

- Review your total debt in the dashboard

- Choose your payoff plan

Undebt.it gives you the flexibility to choose a debt payoff plan that works and shows you everything you need to know to start paying off your debt fast.

Learn more about Undebt.it here.

6. Side Hustles to Help Pay Off Debt

One of the best ways to pay off your debt fast is by bringing in some side income. When you start bringing in extra income you can start making serious headway with your debt snowball. Even an extra $100 a month will make a noticeable impact.

There are tons of different side hustles available. Here are a few side hustle ideas that you can do to boost your income and pay off debt faster.

Sell Your Stuff

The quickest way to make money right now is simply selling stuff you don’t need anymore. Using an app like Facebook Marketplace is a great way to quickly list items in your house that you don’t need.

Whether it’s the bikes in the garage that your kids outgrew or clothes you simply don’t wear anymore, you can quickly snap a few pictures and list them. This is a great way to make money fast and throw it at your debt payoff.

Become a Delivery Driver

Places like Postmates, Uber, and Instacart are hiring people to shop for and deliver people’s groceries, take-out, and everything in between.

You can sign up and start earning money quickly by simply delivering other people’s orders!

Note: Make sure to be aware of your costs. You are paying for gas and taking the depreciation on your personal vehicle when doing this job, so make sure you are earning enough to make it worth it.

Play with Pets

Pet-sitting is a real side hustle that can actually pay well. Websites like Rover allow people to request someone to watch their pet while traveling or away from home.

You can join and get paid for hanging out with other people’s pets, stacking extra cash to throw at your debt payoff.

No matter what you end up doing, making money on the side each month can accelerate your debt payoff in a HUGE way!

7. Keep Having Fun

Paying off debt is not about living on nothing, eating ramen, and hating your life. Yes, it requires sacrifice, focus, and commitment but make sure to budget in a little fun along the journey or you will burn out and give up.

A great way to do this is to celebrate your debt payoff milestones. Pay off a credit card? Treat yourself to dinner. Pay off $1,000 on your student loan? Buy yourself a (modestly-priced) gift!

Having fun on your debt payoff journey will help you stay motivated to keep pushing ahead.

Related: How to Celebrate Paying Off Debt Frugally

Paying Off Debt Quickly Is Possible

It can feel hard to stay motivated while paying off debt, but using these tips will help you stay the course. Not only that, you can pay off your debt fast if you simply commit to a plan and stick with it.

If you want to take all the math off the table and let someone else show you the BEST ways to pay off your debt fast, click here to learn more about how Undebt.it can help.