Why Undebt.it Beats the Best Debt Payoff Spreadsheets

If you want to pay off debt, calculating the full extent of your financial situation can be difficult. It may also be hard to find the motivation to follow through on your debt payoff plans. Luckily, a debt payoff spreadsheet can help.

When you set up your spreadsheet, you’ll be forced to face the reality of your financial health. Depending on the amount of debt you have, this can be a critical moment. A spreadsheet can help you look at the numbers and create a realistic repayment plan.

Having the numbers front and center can simplify the thought process of paying down debt. While you’ll likely need to make some big changes to your spending habits, a payoff debt spreadsheet can help illuminate your path to becoming debt-free.

Best Payoff Debt Spreadsheets

Getting serious about paying off debt means sitting down and taking stock of your situation. It’s possible that you’ve never really taken a hard look at your debts as a whole.

Entering all of your information into a calculator or payoff debt spreadsheet gives you a chance to do that. It also calculates the date you’ll be debt-free, which is incredibly motivating.

Figuring out a repayment plan may seem tricky when you are trying to eliminate your debt. Fortunately, a payoff debt spreadsheet can help.

Here are a couple of the top options for debt payoff spreadsheets.

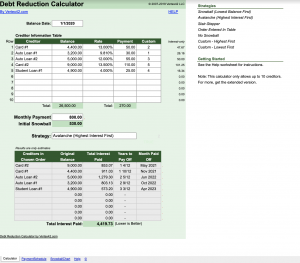

Vertex42 Debt Reduction Spreadsheet

Vertex42 offers a free debt reduction spreadsheet as both a Google Sheet and Excel file. The goal is to help you understand your debt repayment options.

To get started, you’ll enter all of the information needed about your outstanding debts. Next, you’ll be able to compare three repayment strategies. With the spreadsheet, you can run through different stimulations of how to pay off your debt.

To update it, you’ll have to get your new balances as your statements roll in. The only way to see your history is to keep copies of your old spreadsheets.

This spreadsheet is not mobile-friendly, so you’ll have to use it on your computer.

Overall, this spreadsheet is very straightforward. You’ll provide the numbers, and the sheet will project a payoff timeline based on your chosen repayment strategy.

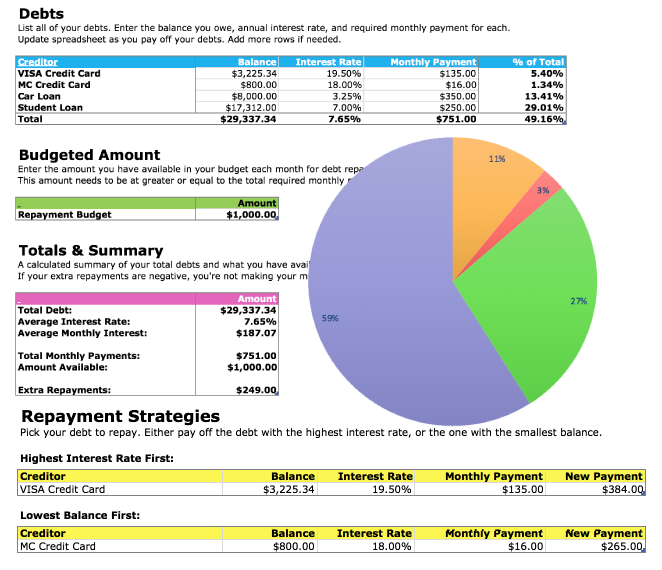

Squakfox

The original spreadsheet offered by SquawkFox will ask you to list your lenders, outstanding balances, interest rates, and minimum payments. Once everything is in the spreadsheet and you’ve set a monthly repayment budget, you’ll be able to see a timeline for two repayment strategies.

The updated version of the SquawkFox spreadsheet provides a nicer visual experience. Instead of a basic sheet, you’ll find colorful charts and graphs to help you visualize your options more clearly.

Both of these debt reduction spreadsheets are available as downloadable Excel files.

Undebt.it vs. Other Debt Spreadsheets

Spreadsheets are great for one-time check-ins. But, if you want a tool that keeps you motivated every month and that you can work with over time, Undebt.it beats the best debt payoff spreadsheets.

Here are some of the features that set Undebt.it apart.

Undebt.it Snowball Calculator

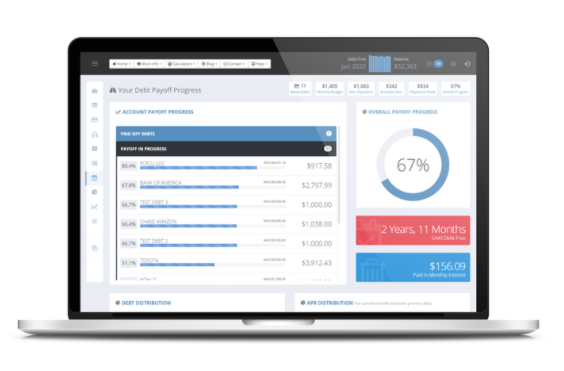

The free Undebt.it debt snowball calculator is like a spreadsheet on steroids. Like the other spreadsheets you’ll find on this list, you’ll enter in your debt information. Then, it will give you your debt-free date. This is pretty exciting to see.

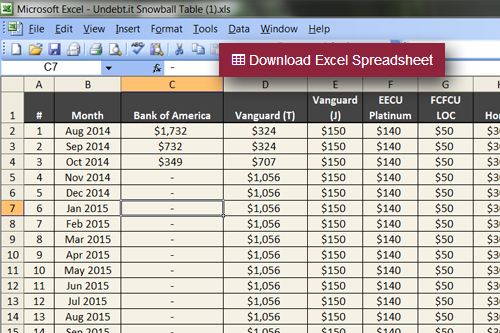

Once you sign up for the free tool, you’ll be asked to enter details about your outstanding debts. You can then head to the dashboard to see where you stand and review the debt snowball table. This will show you exactly when each debt will be paid off and how much interest you’ve paid.

| Undebt.it | Vertex | Squakfox | |

|---|---|---|---|

| Number of payment plans | 7 | 3 | 2 |

| Number of debt accounts | Unlimited | 10 | Unlimited |

| Gives final debt free date | Yes | Not obvious | No |

| Mobile friendly | Yes | No | No |

| Easily tracks progress | Yes | No | No |

| Supports temporary promo rates | Yes | No | No |

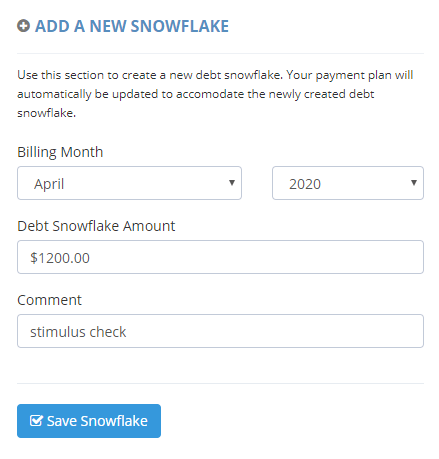

Debt Snowflakes

If you have extra money to apply to your debt, Undebt.it allows you to add debt snowflakes to your payment plan. Undebt.it then adjusts your debt-free date based on these extra payments.

For more information about debt snowflakes, read our article here.

Updating Functionality

Another big difference between Undebt.it and debt payoff spreadsheets is how you update them. With Undebt.it, you update your account by entering your payments made while you update the spreadsheets with the new balance when you get your statements. Updating the calculator when you make a payment is much easier, more timely, and satisfying than waiting until you get your new statement to update the balance. It also allows the calculator to track your history. This is something the spreadsheets just can’t do.

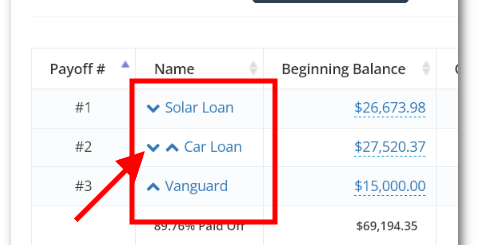

Payoff Strategies

Undebt.it offers seven different payoff strategies, including the popular debt snowball and debt avalanche options. However, you’ll also find other payoff strategies to consider, like the debt hybrid, highest monthly payment, highest credit utilization, or highest monthly interest paid. You can even create a custom plan. With Undebt.it, it’s easy to choose which strategy works best for your financial goals after exploring what the free calculator has to offer. Other spreadsheets are much more limited in terms of payoff strategies.

Related: The 7 Undebt.it Payoff Plans

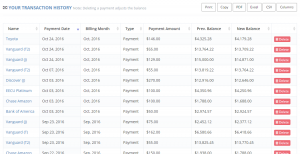

Payment History Tracking

It’s easy to add payments to your dashboard or debt account details page with Undebt.it. Then, Undebt.it will automatically adjust your due date and account balance. You can effortlessly add multiple payments by choosing the same billing month. Better yet, Undebt.it keeps a sortable and exportable history of payments and purchases for all of your accounts.

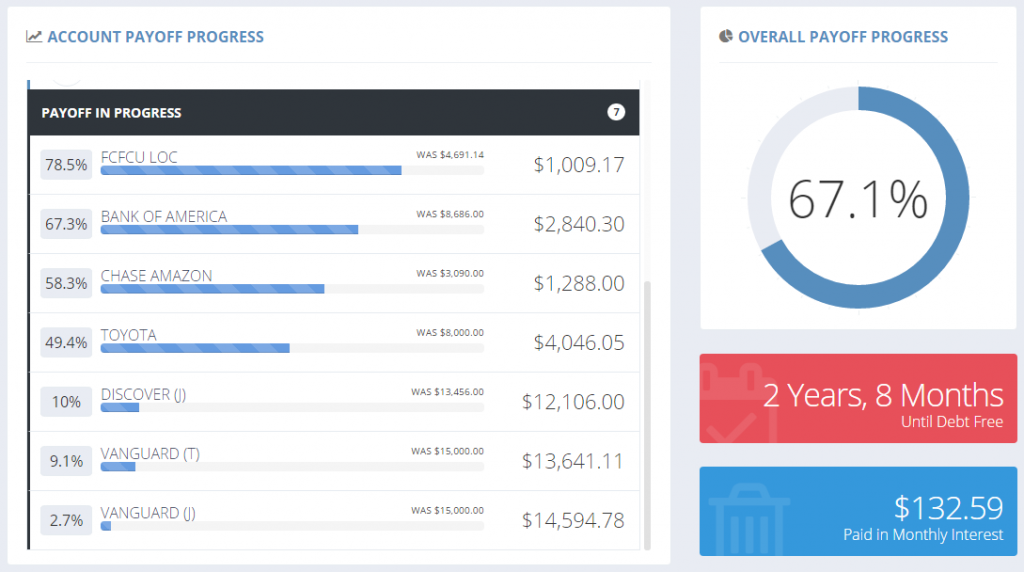

Tracking Your Progress

Undebt.it’s progress page shows you a quick snapshot of your payoff progress. You can quickly see which accounts you have paid off and your progress on your active debt accounts. The progress page also shows you when you will be debt-free and how much the interest on your debt costs you each month.

Credit Utilization Tracker

Credit utilization is the percentage of your credit you are currently using. This percentage plays a big role in your credit score. Undebt.it helps you easily track this information on the credit utilization page. This page will show you your utilization rate on each of your accounts. It will also show you pie charts of the distribution of your interest rates and types of loans.

Undebt.it Export Options

One problem with traditional spreadsheets is that they can only be used on a computer. While Google Sheets can technically be accessed from your phone, they don’t format very well. This makes it hard to use debt payoff spreadsheets from your phone. Additionally, Excel doesn’t have online access at all. Fortunately, Undebt.it can be exported to Excel if desired and is mobile-friendly.

Undebt.it+ vs. Other Debt Spreadsheets

Undebt.it+ is the premium version of Undebt.it and adds some really cool features. (Here’s the full list.)

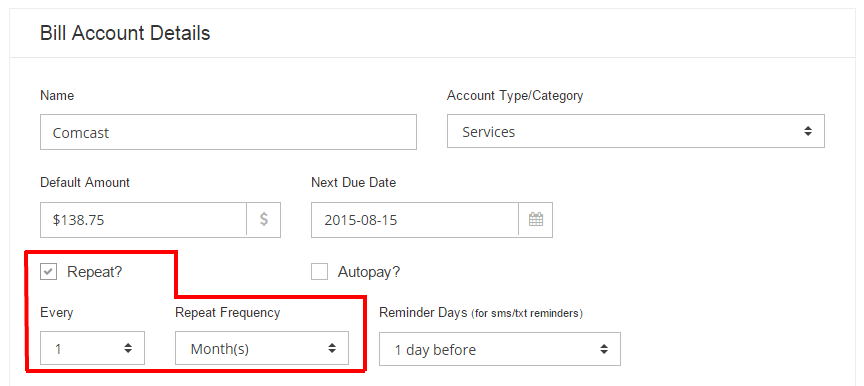

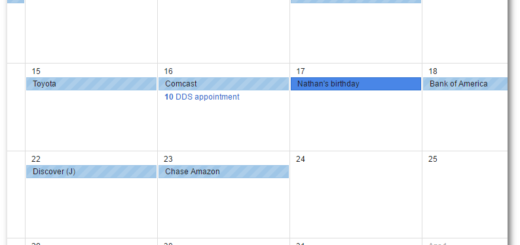

Undebt.it+ Tracks Recurring Payments

One of my favorite premium features is the ability to track non-debt recurring payments, like cell phone or utility payments. You can see in a calendar view exactly what bills you have coming up. This includes both debt payments and your regular bills.

Read more about the Bill Management module.

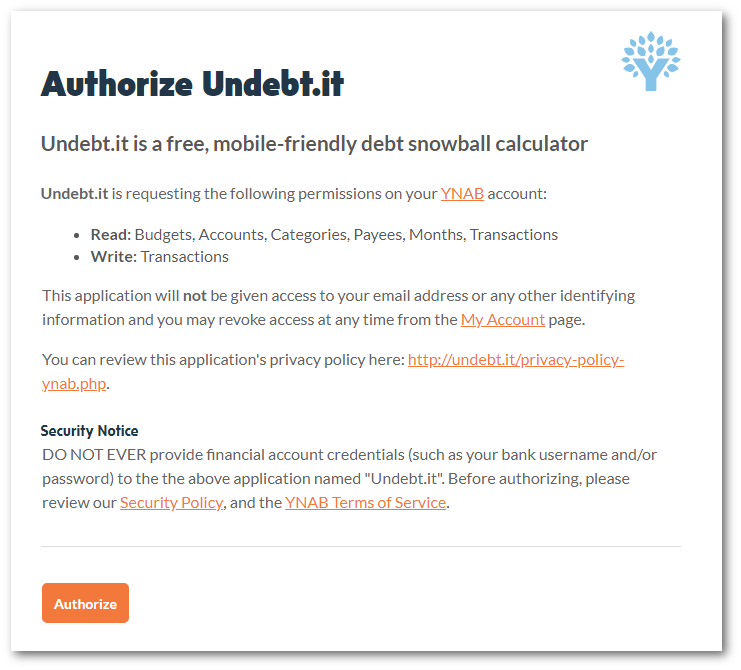

Undebt.it+ Integration with YNAB

Another handy premium feature is that you can have the calculator update your payments automatically with the YNAB integration. YNAB is our favorite budgeting tool and allows the calculator to update automatically.

Read more about how Undebt.it works.

How Do I Use a Debt Payoff Spreadsheet?

There are four easy steps to using a debt payoff spreadsheet:

1. List Out Your Debts

Any debt payoff spreadsheet will ask for information about your debts. You’ll likely need to include your lenders, outstanding balances, interest rates, and minimum payments.

2. Determine Your Repayment Budget

How much can you afford to put towards debt repayment each month? If you aren’t able to make more than the minimum payments, then you’ll be stuck in debt for a long time. Consider creative ways to boost your income or eliminate expenses to get rid of your debt for good.

3. Pick A Repayment Strategy

There are many ways to tackle debt repayment. The two most common choices are the debt snowball and the debt avalanche methods. With the debt snowball, you’ll start by paying off your smallest loan first. With the debt avalanche, you’ll start with the loan that has the highest interest rate. Both are effective ways to pay down debt, so you’ll need to choose which one works best for you.

Related: What is the debt snowball?

4. Stick To The Plan

Once you set up a repayment strategy, you’ll need to stick to the plan. If you don’t consistently pay down your debts, you’ll find it challenging to make lasting progress. While you may need to take a break along the way, always keep moving towards the goal of paying off your debts.

Related: How to Temporarily Pause Your Undebt.it Debt Snowball

The Bottom Line

As you begin your debt payoff journey, a payoff debt spreadsheet could help you stay on track. However, the easy-to-use interface offered by Undebt.it could be a better choice as you decide which repayment strategy is best for you. Whichever option you choose, make a plan and get rid of your debt for good.