You Need a Budget (YNAB) Integration with Undebt.it

One of the most popular requests I get is that users want to be able to connect their online bank/credit card accounts to Undebt.it. There are a number of things that make this request not feasible right now: mainly because it’s hard to do right and it’s expensive, both in time and money. So one way to get around that obstacle is to tie into another service that does do account aggregation.

Fortunately, YNAB has made this process relatively easy to do so I’m happy to announce that the integration is ready to go and if you’re already a user of both services then your life just got a little easier. YNAB has an excellent API and a very active community so I’m excited to get this going.

What is YNAB?

YNAB is a unique budgeting software that follows four simple rules when it comes to budgeting:

- Give every dollar a job

- Embrace your true expenses

- Roll with the punches

- Age your money

It works on the principal to live on last month’s income. This breaks the paycheck to paycheck cycle and allows you to be truly in control of your finances.

Related: YNAB Review 2021: The Best Budgeting App?

What the YNAB and Undebt.it Integration Means for You

Here’s what the integration can do for you:

- Update your Undebt.it account balance: This feature will keep your debt account balance current with whatever YNAB has. This means that if you have your credit card account in YNAB tied to your online account and reconciled, everything will update automatically.

- Import your YNAB transactions: Undebt.it users won’t have to manually record their payment transactions once this option has been turned on. The payments and purchases you make on your credit card will be brought over to Undebt.it automatically.

Basically, your Undebt.it+ account will update automatically when your YNAB account does.

Here’s What You Need to Make This Work

There are two things that are required to make the link work:

- An active YNAB account. They offer a free 34 day trial so you can try before you buy.

*If you click on the link above and sign up for an account, I get a referral bonus 🙂 - An active Undebt.it+ account. There is a one-click, free 30 day trial available

Since both services offer a free 30 day trial you have the ability to try this out for free and see if it’s for you. The YNAB service then costs $84 per year and Undebt.it+ costs $12 per year (or less if you can find a promo code). So for less than $100 per year, you can have both these services and really make a dent in your debts.

Getting Started with the Integration

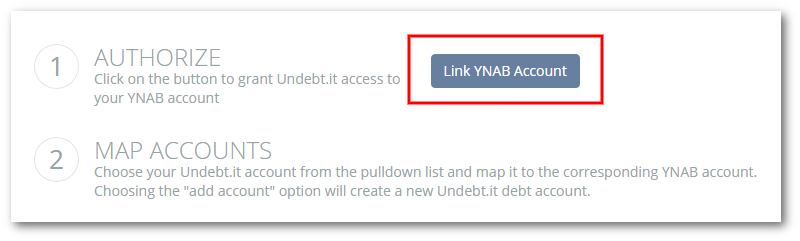

Log into your Undebt.it account and go to the YNAB Sync page (it’s located in the “My Account” link section and also on the left menu) and click on the “Link YNAB Account” button.

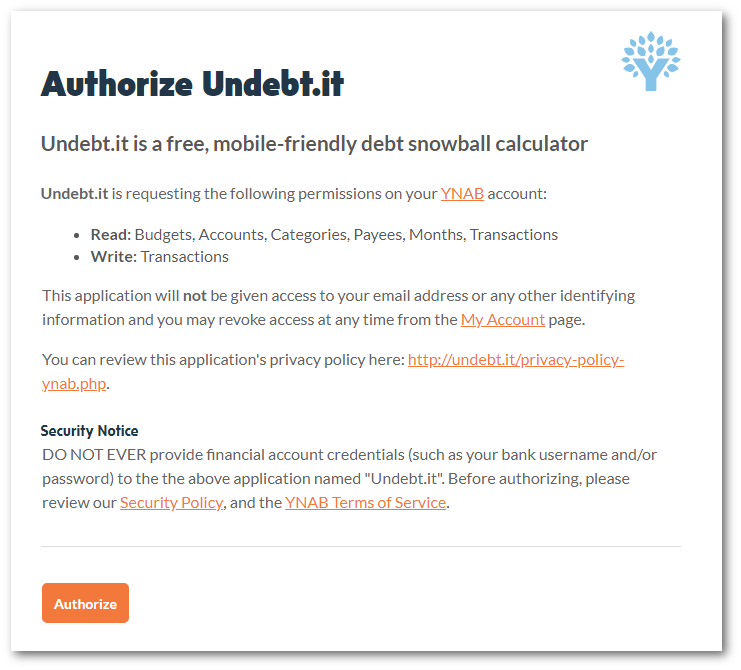

Once you click on the button, you will be direct to the YNAB site where you will need to allow Undebt.it access to your account information before you can proceed. I have updated the privacy policy to reflect the new YNAB integration features and how your data is handled. It’s important to note that Undebt.it never has access to your bank account login credentials at any time.

Mapping Accounts

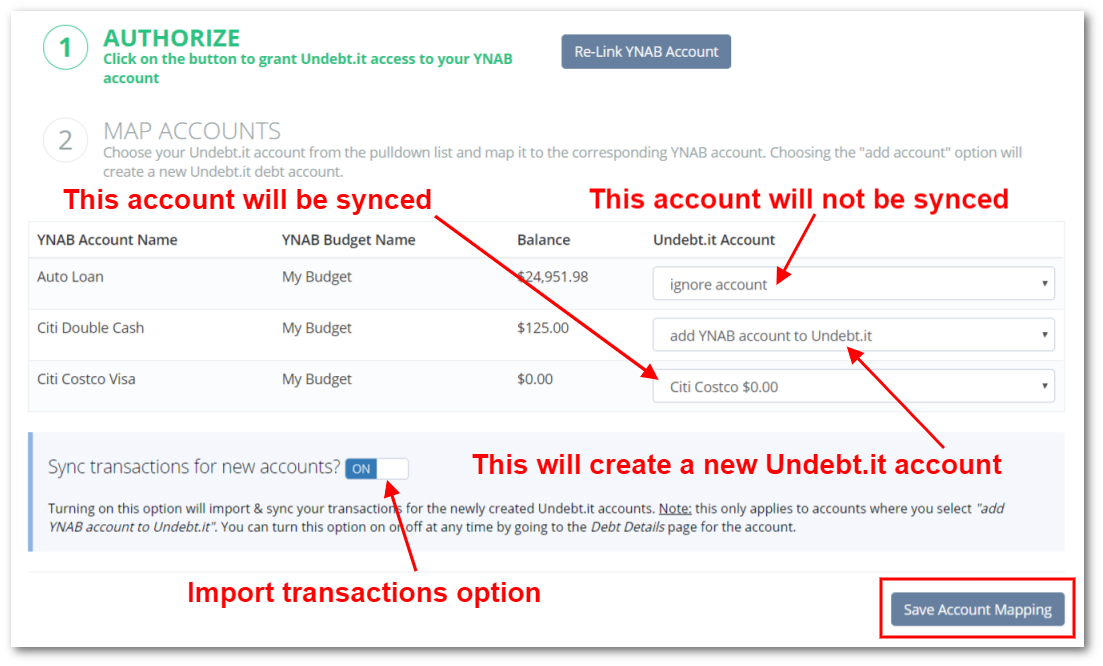

The next step is setting up the mapping of the accounts between the two sites. You will see a list of all of the accounts you have setup in YNAB along with their current balances. There are three choices you have on these accounts:

- Ignore the account: Undebt.it will not do anything with the account. Use this option if you don’t want to manage this account with Undebt.it.

- Add the YNAB account to Undebt.it: This will create a new Undebt.it debt account and then add it your list of active debts. Once the account is created, be sure to go to the Debt Details page for the new account and change the interest rate, due date, account type and any other settings that YNAB does not store.

- Assign the YNAB account to the proper Undebt.it account: Use the pull-down list to match each account as needed. The current Undebt.it balance is also shown in the list, next to the account name.

If you are mapping YNAB accounts to new Undebt.it accounts, there is an option labeled “Sync transactions for new accounts?” that applies to you. Turn the option on to bring over the transaction history along with the account balance. New transactions will be automatically added to Undebt.it during the syncing process.

When you are done with the mapping, click the “Save Account Mapping” button and your account balances will be updated. You don’t have to do all of the mappings at once; you can come back to this page and map an account or two whenever you like.

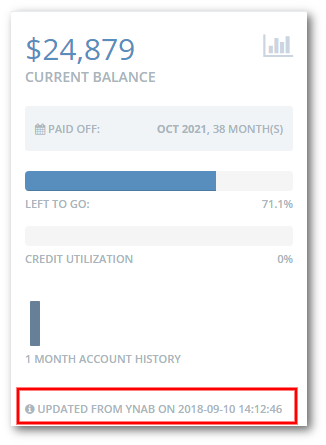

If you want to make sure everything is working as expected, go to the Debt Details page of a sync’d account and you should see a current sync date like in this screenshot.

Syncing Account Balances

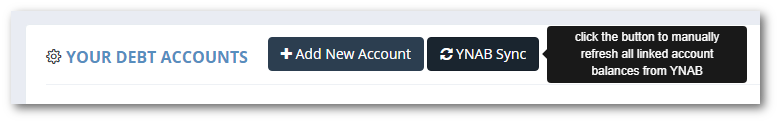

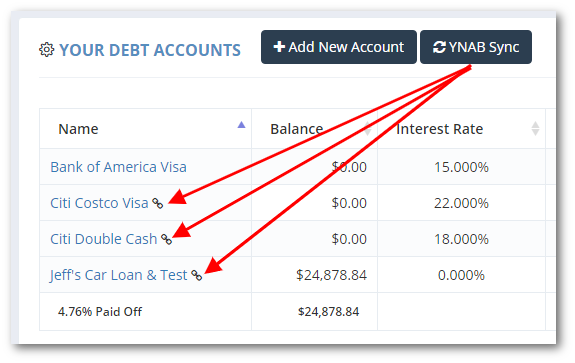

Your account will automatically sync itself so there is no action required on your part. However, if you want to manually sync your YNAB data, go to the Account List page. Click on the “YNAB Sync” button updates all of your linked accounts.

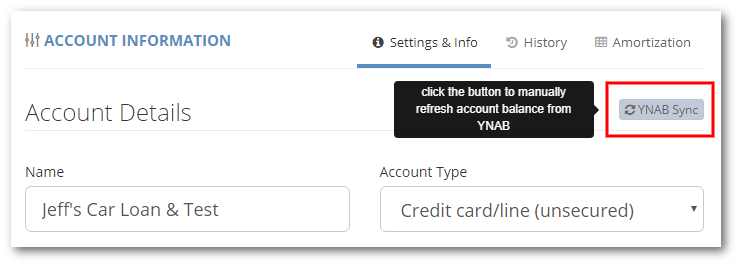

There is also a similar button on the Debt Details page, but this one only updates the selected account. The preferred method is to use the one on the Account List page to cut down on API traffic since it updates all of your accounts at once.

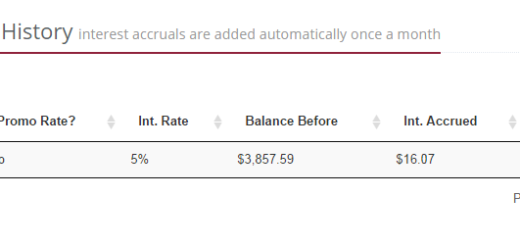

Syncing Transactions

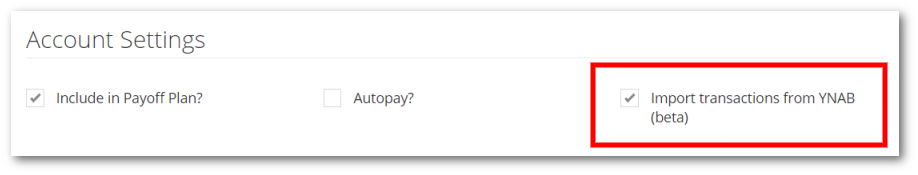

You can also import your account transactions by going to the Debt Details page of the account your want to sync. Check the box labeled “Import transactions from YNAB”. The next time you click on the sync button, all of the transactions will be imported into Undebt.it

Handling Payment Transactions

If you have the YNAB integration turned on, then there are 3 ways to handle payment transactions. It’s important to just use one of these methods for each debt account.

- Import from YNAB: (as shown above) Have the payments flow from YNAB into Undebt.it automatically.

- Autopay: This is the standard “Autopay?” option on the debt details page. The payment transaction is automatically recorded in Undebt.it based off of the planned payment amount (regardless of what YNAB has).

- Manual: You can create manual payment transaction entries on the debt details page in the “add a transaction” section.

For example, let’s say you have a credit card in YNAB that is linked to your lender. If you want to have everything automatically brought over into Undebt.it, you would want to use the import from YNAB option. However, if you have a loan that is not linked to YNAB, you will want to use the standard autopay or manual options.

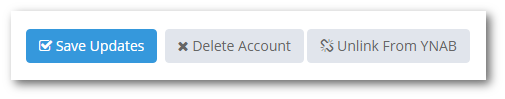

Un-linking Accounts

If you want to stop an individual account from syncing with YNAB, just go to the Debt Details page and click the button labeled “Unlink From YNAB”. Repeat for each account you would like to un-link.

Some Important Notes Regarding the Integration

YNAB reserves the right to revoke access to their API at any time. This means that this feature can stop working sometime in the future and there is nothing I could do to fix it.

If you try out the integration and it’s not working out for you, you can revoke Undebt.it’s access to your YNAB account at any time by logging into your YNAB account, then go to Settings > Authorized Apps and click on the revoke link.

Summary

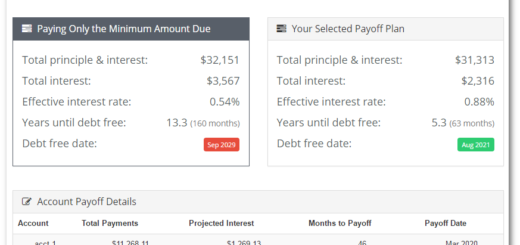

The YNAB integration takes Undebt.it+ to a whole new level. It allows for automatic updates of your accounts in Undebt.it, which means you no longer have to manually enter payments or update account balances.

It’s perfect for current YNAB users, but we highly encourage those who haven’t tried YNAB yet to check it out.

This is really great. Thank you.

While I love the YNAB integration, it isn’t really integrated yet. It imports transactions, but doesn’t apply them to the debt history, so they don’t show up in the payoff plan. If you look at the debt history, there is no running total kept and the software doesn’t know that you have made any payments that month. I have been making this work by manually going in and adding balances on accounts where I do not make purchases, but it is just too much to do on my active card.

Been having issues with YNAB history being imported multiple times. As in, I may have 8 duplicate transactions for a given month’s payment. The balance keeps up correctly, but the payments get hugely inflated. I would love a fix, as I love YNAB integration. However, for now I’m just going to purge all the excess payments, sync one last time to get my history back, and then unlink all my accounts.

This issue has been resolved

Was this fixed very recently? I was still seeing the same transactions import last night when syncing with YNAB. Is there anything I should do, like disconnect/reconnect my accounts with YNAB?

Yes, it was just the other day. You can use the contact form or a Facebook message to send me your account info so I can check it out.

Is what Janet says above true? If I sync YNAB transactions, will Undebt.it not apply payments made within YNAB to the debt history and payoff plan?

No, it’s not correct. They are treated like any other purchase/payment transaction.

Great, thank you!

Thanks again for this awesome feature. Does this only pull in cleared or reconciled transactions, or just anything entered into the YNAB register?

It brings over cleared or reconciled transactions

Want to follow up on my note above about the duplicate imports I was seeing from YNAB. I worked with Jeff, giving him details on an account where I was seeing this. I can’t say enough good things about him working on a solution, responsiveness, and most of all his friendliness! Everything’s been working perfectly, and I love this feature that allows me to input less manual information!

As an aside – I think the premium access to this site is grossly underpriced for all you get (compare to the annual cost of YNAB or similar tools). I’d encourage all who can to figure a way to pay a little more; something closer to the true value of the product!

Just curious, how often does Undebt.it sync with YNAB?

Also my current budgeting methodology in YNAB is to treat the debt payments coming from my chequing account as “transfers” to the debt account which automatically creates an associated payment transaction in the debt account. This of course ignores any interest which accumulates so at the start of every month, I manually update the debt account balance to reflect the interest accumulation.

Will this approach work with the YNAB sync integration in Undebt.it?

Thanks in advance!

Syncs happen roughly every two days. All of the transactions will be brought over but all of the transfers you make will count as payments so it can cause problems with the budget amount.