What is a debt snowball?

The debt-snowball method is a debt reduction strategy for revolving credit (credit cards and other unsecured lines of credit) that can be applied when you have one or more debts and can afford to pay at least the minimum required payment. The basic snowball plan pays off the accounts starting with the smallest balances first while paying the minimum on larger debts. Under this method, extra cash is dedicated to paying debts with the smallest amount owed. Once the smallest debt is paid off, one proceeds to the next slightly larger small debt above that, so on and so forth, gradually proceeding to the larger ones later. The primary benefit of the smallest-balance plan is the psychological benefit of seeing results sooner.

Where to start?

This method has gained more recognition recently because it is the primary debt-reduction method taught by many financial and wealth experts, such as Dave Ramsey. I highly recommend starting out with his book, The Total Money Makeover. Buy it used or borrow it and it may very well change your outlook on the burden that debt can place on you and your family. His approach is fairly preachy, which may turn off some, but the core message is very important.

Snowflake payments

Snowflake payments are any additional payments other than the snowball that you can apply towards your debts. For example, if you are planning on getting back a tax return and would like to apply it towards your debts, just go to the snowflake management page and add it to the month you will make the payment. You can add as many snowflakes for each month as you want. Undebt.it will total them up and make the proper calculations. Negative amounts are also supported if you know you will not be able to make the full snowball payment.

Other debt management methods

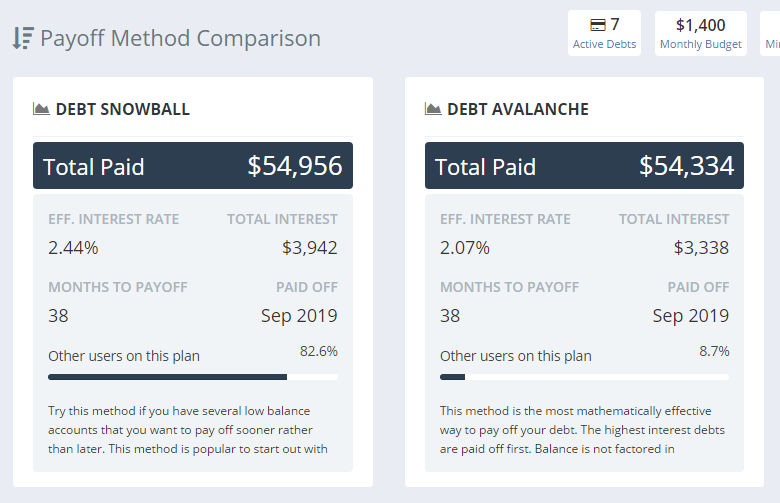

The snowball method has proven to be a very effective method to getting out of debt, but you may pay just a little more in overall interest than another method - the debt-avalanche method, also known as "debt stacking". The avalanche method is similar to the snowball, but instead of starting out with the highest balance debt, you start with the debt with the highest interest rate. I usually recommend starting out with the snowball method because the motivation of paying off some smaller debts quickly will help you stick with it, then switch over to the avalanche method. Both of these methods are fully supported by Undebt.it and you should choose which one you think will work best for you. Use the snowball table to see which method will give you the best results. Undebt.it also supports custom payment methods where you will be able to pick the order of the payment plan. There is even a payoff method where you can payoff the accounts with the highest monthly payment. Last but not least is the Debt Blaster payment plan - you incrementally increase your budget over time to get out of debt in no time. You will only find the Debt Blaster plan here at Undebt.it.

Snowball Debt example

A person has the following amounts of debt and additional funds available to pay debt (the debt is listed with the smallest balance first, as recommended by the method):

- Credit Card A - $250 balance - $25/month minimum

- Credit Card B - $500 balance - $26/month minimum

- Car Payment - $2500 balance - $150/month minimum

- Loan - $5000 balance - $200/month minimum

- The person has an additional $100/month which can be devoted to repayment of debt

Note that interest rate is not factored in the debt snowball method, only the balance. Under the debt snowball method, payments for the first two months would be made to debtors as follows:

- Credit Card A - $125 ($25/month minimum + $100 additional available)

- Credit Card B - $26/month minimum

- Car Payment - $150/month minimum

- Loan - $200/month minimum

After two months (presuming the person has not added to the balances, which would defeat the purpose of debt reduction), Credit Card A would have been paid in full, and the remaining balances as follows:

- Credit Card B - $448

- Car Payment - $2200

- Loan - $4600

The person would then take the $125 previously used to pay off Credit Card A and apply it as additional payment to the Credit Card B balance, which would make payments for the next three months as follows:

- Credit Card B - $151 ($26/month minimum + $125 additional available)

- Car Payment - $150/month minimum

- Loan - $200/month minimum

After three months Credit Card B would be paid in full (the final payment would be $146), and the remaining balances would be as follows:

- Car Payment - $1750

- Loan - $4000

The person would then take the $151 previously used to pay off Credit Card B and apply it as additional payment to the car loan balance, which would make payments as follows:

- Car Payment - $301 ($150/month minimum + $151 additional available)

- Loan - $200/month minimum

It would take six months to pay the car loan (the final payment being $240), whereupon the person would then make payments of $501/month toward the loan (which would have a $2800 balance) for six months (with the last payment at $234). Thus in 17 months the person has repaid four loans, with two of them being paid in a mere five months and three within one year. (example from Wikipedia)

Which method should I use?

The short answer to this question is "it doesn't matter". As long as you're adding the extra amount to your debts each month, you're on the right track. Unless you are dealing with huge debts like mortgages, it doesn't really matter which method you use. Your payoff month will probably be within a month or two for each of the payoff methods. The chart below is an example of a pretty average set of debts. Use the plan that works best for you.