How to apply extra money to your debt payoff plan

So Now You Have Some Extra Money – Now What?

This post is going to go over how to apply extra money to your debt payoff plan – and by “extra”, I mean extra on top of your existing debt snowball. There is a feature on Undebt.it called Additional Payments (aka Debt Snowflakes) that allow you to temporarily adjust your budget for a given month. The purpose of this feature is to plan ahead for any variations in your budget so your debt snowball can be flexible as needed. The nice thing about this feature is it can be positive or negative. You can even have more than one snowflake per month – the amounts will be totaled. Here are a few examples where this may help you budget your debt snowball:

- You know you will be getting a tax refund in March and want to put an additional $2,000 of that towards your debt. Normally your debt snowball amount each month is $500 but in March you’ll be paying $2,500 to your snowball.

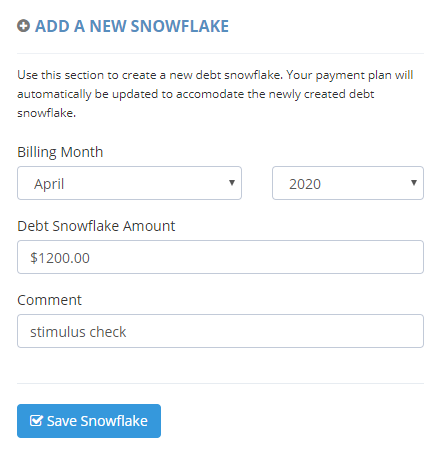

- You get a $1,200 stimulus check in April and want to throw it all at your debt.

- You get three paychecks a month twice a year and you want to put $1,000 of your extra paycheck towards paying down debt. Create one for each month you get your extra paycheck.

- You plan on spending $400 extra around Christmas time so you create a negative debt snowflake. Therefore, since your regular monthly debt snowball is $500, it will be adjusted down to $100 in December.

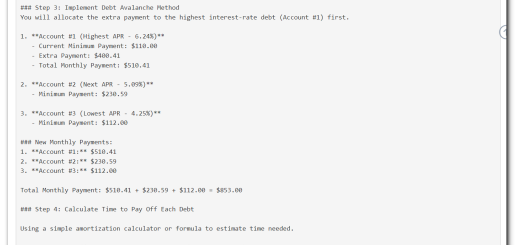

Before we get started, I’ll use an example of having a $1,000 regular snowball amount. I’m going to add a $1,200 debt snowflake. Here’s how the budget looks before the snowflake is applied to the current month

Adding a New Debt Snowflake

Head over to the Additional Payments section to mange your debt snowflakes. You can create as many as you want, for as far out as you want.

In the Add a New Snowflake section, fill in the info for the snowflake and press the Save Snowflake button

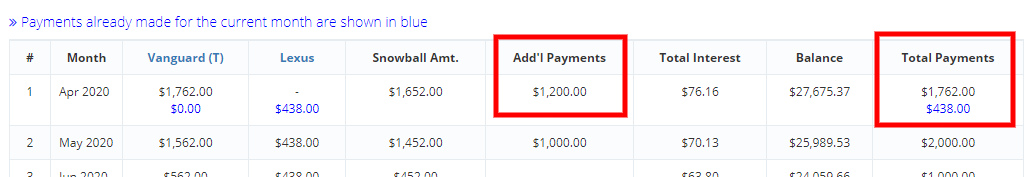

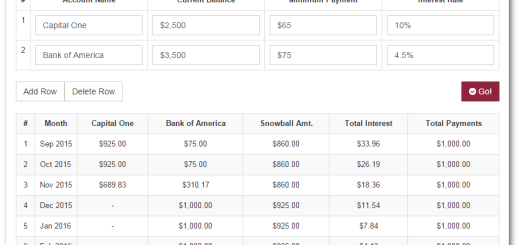

Now that you have added your debt snowflake, you can see how your plan will be affected. You can also edit or delete the snowflakes as needed. Here’s the new budget for this month (note that this number will only change if there is a snowflake on the current month):

The extra money shows up in the Add’l Payments column. The Total Payments column shows the updated amount totaling $2,200. You can see that I have another snowflake scheduled for next month for $1,000.

The feature works on both free and premium accounts. Please remember to share on social media if you like the site and thanks for your feedback and continued support.

Say in two years I start to collect Social Security and I want to use that money to add into my snowball. Do I need to add an additional payment each month each time, or can I start at a date two years from now and make it auto each month after? Or do I go back and edit the extra budget amount that I began with and just change that?

Right now you would have to create one for each month. However, I’m planning on adding the ability to use a date range at some point

Thanks Jeff, this is great program

You’re welcome!

Hi. Right now the extra payments arrange alphabetically when you sort by date. So April 2019 would be above May 2020. It would be nice to have the field sort as an actual date field.

If i have it syncing to YNAB, do i need to add the snowflakes? or will it just sync across?

You will still need to create the snowflakes. It’s really the beginning on the cycle: 1) create a payment plan on my site. 2) make the actual payment. 3) YNAB will pick it up from your bank. 4) Undebt.it will get the payment from YNAB. Hope this makes sense.

Hi there! If I just make a higher monthly payment in YNAB on one of my debt accounts will the results be the same toward my debt snowball? Or does the snowflake payment change the budget and calculate differently.

Your snowball amount will change for the month since you made a higher than planned payment

So I did this tonight and the total payments amount didn’t change. And I can’t see how it knows which debt to apply it to? I’m so confused.

If you go to the snowball table page, does the amount show correctly on the snowball column? It will apply the extra payment amount to the first debt in line to be paid off.

It showed up in the extra payment column in black. But it didn’t add it to anything. The total payments amount was unchanged as was the payment amount for the smallest account with the snowball. I even added one for $1000 to see if anything updated and it didn’t. The payoff dates didn’t even change.

I am experiencing this same issue

Is it for the current month? If so, do you still have accounts with a due date set to this month?

There seems to be something off with doing a snowflake payment and syncing with YNAB. maybe I am confused but if I make the payment in YNAB it removes the debt balance and throws off my payoff table making the snowflake want to go to a bill I didnt payoff.

Did the payments post in January? If so, I recommend going to the “payment history” page and changing the “billing month” of the payments to February. Once you do that, the amounts will show up in blue and the snowflake will be properly allocated.