Dealing with Deferred Interest Accounts

What exactly is deferred interest?

Before I get to far along with how the site deals with deferred interest, I wanted to go over what exactly deferred interest is. If you have signed up for an account with terms that are something like: “pay no interest on purchases if paid off within x months” or “90 days same as cash”, then you have a deferred interest account. This means that if you do no pay off the entire balance before the end of the promotion, then you will be charged interest at the full rate dating back to the original date of the purchase. This is important to understand because almost all of these deferred interest accounts have very high standard interest rates (like 20% and higher). This is a huge liability and for that reason I recommend paying off these accounts first. Here’s some more info about deferred accounts from the Consumer Financial Protection Bureau:

- You need to pay off the full balance by the end of the deferred interest period, or else you could have to pay all of the interest that you expected to be deferred. That means you would owe all of the interest back to the original date of the charge.

- You still need to make at least your minimum payments when they are due. If you’re more than 60 days late making your payments, you could lose the deferred interest period. Note that a single late payment could have other consequences, like late fees.

- Your minimum payments probably won’t be enough to pay off the entire balance by the end of the deferred interest period.

- If you have other balances on the card that have a higher APR than the deferred interest balance, any amount above your minimum payment will be automatically applied to the balance with the higher APR. This changes in the last two billing cycles in your deferred interest period, when any amount above your minimum payment will be applied to the deferred interest purchases.

- If you use the card for other purchases, you might lose your grace period on those purchases if you don’t pay off the entire card balance – including the deferred interest portion – at the next payment due date.

What’s the difference between a balance transfer and a deferred interest account?

Some people think balance transfers and deferred interest are the same thing, but they have a very important difference once the promotion ends. With a standard balance transfer account, you start paying your regular interest rate on the balance going forward. No back interest is charged with a balance transfer. I recommend using rotating balance transfers as an effective way to get out of debt.

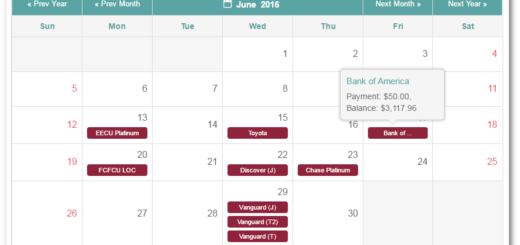

How does Undebt.it deal with deferred accounts?

For some time now, there has been a check box labeled “Deferred interest?” on the debt details page as a way to mark an account as deferred. However, the flag was just for informational purposes – it didn’t have any effect on the payoff schedule or interest calculation. Starting May 22, 2017 this field will become a factor in the payoff order. Any accounts marked as deferred will be bumped up to the top of your payoff plan. Getting hit with a large amount of back-interest charges is a huge hit to your debt payoff plan and needs to be avoided at all costs.

More details

One important thing to note is that custom plans are not effected by the deferred flag. This allows you to keep full control of your plan all the time. If you have an account that is deferred and you want to pay off another account for whatever reason, you will need to use the custom payoff method to make that happen.

Another important thing to note is that the site does not adjust for the back-interest rate for you if you don’t pay the balance before the promo ends. You will have to manually adjust your balance as needed.

Cool stuff! This site has come a long way and you are doing an awesome job. Question, what happens if you have multiple promos on a single card? E.g. CareCredit for example, and also on CapitalOne – I have separate line items with separate interest rates on the same card. CareCredit I have one lower interest longer-term, and one “deferred interest” – Capital One I have one sitting at the normal APR and one sitting at a balance transfer APR.

Thanks Hannah – This question comes up a lot and i’m planning on adding support for this in the future, but it will be pretty difficult. In the meantime, I recommend just calculating the weighted average for the account and use that number as your interest rate.

I recently joined undebt.it and saw this post. Hopefully it’s not too late to make a suggestion. I also have CareCredit and take full advantage of their promotional purchase option. 🙂 What I did was create a separate debt account for each promo balance. That way I can enter the different promo expiration dates, balances, etc. for each one. It makes it easier to keep track of when each promo expires, plus it assigns a payment amount to each promo balance. I then plan to combine the payments for each promo that undebt.it recommends and pay that in one month. I’m not sure if this is the best way, but it just seemed logical to me.

That sounds like a pretty good way to deal with it. I’m planning on adding support for multiple interest rates and dates for accounts in the future.

How do I calculate weighted average?

How do I deal with balance transfers? I want to transfer a balance I’m currently paying off onto a balance transfer card I was just approve of. How do I do that on undebt it?

You can use the promo interest section on the account details to set how long the promo rate is good through. I recommend using the custom payoff method when dealing with balance transfers because it gives you full control over how you leverage the balance transfer.