What Is Credit Utilization?

Credit utilization is a key factor that impacts your credit score. It also influences your ability to make major purchases and manage your debt effectively. But what exactly is credit utilization?

In a nutshell, it is the percentage of your credit limit that you are using. Beyond that, it can impact your credit score and your financial health.

Here’s what you should know when it comes to credit utilization rates and how to improve them.

What Does Credit Utilization Refer To?

Your credit utilization rate refers to the percentage of your credit limit that you are actually using.

Credit bureaus determine your utilization rate based on the amounts reported by your lenders. Normally, your credit card issuer will report your usage once per month. Keep in mind that the timing of reporting can vary.

When your balance is reported, credit bureaus will determine your credit utilization rate by dividing your outstanding balance by the total amount you could have spent.

So, if you didn’t use your credit card at all, your credit utilization rate would be zero. Alternately, if you maxed out your card, your credit utilization rate would be 100%.

Once your credit utilization rate is calculated, it is factored into your credit score.

How Is Credit Utilization Calculated?

It is fairly simple to calculate your credit utilization.

First, figure out what your credit limit is. If you aren’t sure, take a look at all of your credit cards. The limit for each one should be easy to find in your account. Once you find all the limits, add them together to determine your total credit limit.

Next, determine your credit card balances. Again, you should be able to find this information in your account. Add up all of your balances to arrive at the total amount you are currently using.

Finally, divide your total credit card balance by your total available credit.

Calculation Example

Let’s say you have two credit cards. There’s a balance of $4,000 on one and $1,000 on another. The credit limits for the cards are $7,000 and $3,000.

In this example, you would have a credit utilization ratio of 50%. Here’s the calculation:

($4,000 + $1,000)/($7,000+$3,000) = 50%

How Does Credit Utilization Impact Credit Scores?

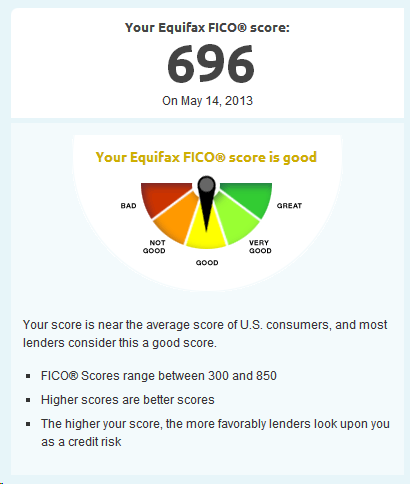

Although your credit utilization rate will affect various credit models differently, you can expect it to account for a relatively large portion of your score.

For example, your credit utilization rate accounts for 30% of your FICO credit score.

However, other factors will affect your credit score as well. These include:

- Your payment history

- Length of your credit history

- Recent credit applications

- Your credit mix

A good credit score can help you manage your debt more efficiently and helps you get better interest rates. As a result, you’ll want to watch your utilization rate closely.

Related: The Credit Score Jumpstart Project

What Is a Good Credit Utilization Rate?

Since credit utilization rates play such a key role in your credit score, it is a good idea to aim for a good credit utilization rate.

Experian recommends keeping your credit utilization at 30% or less. This modest rate shows potential lenders that you can manage your finances responsibly.

How to Improve Your Credit Utilization

Luckily, you can take charge of this ratio in a few different ways. When you lower your ratio, you have the potential to increase your credit score dramatically.

Here are the five ways to help you keep (or get) your utilization on track.

Related: Leveraging Your Credit to Get Out of Debt

Request a Higher Credit Limit

The math behind this ratio is very straightforward. By adjusting one of the numbers, you should be able to impact your utilization rate dramatically.

While you could focus on spending less, that is not always practical. Instead, you might be surprised to learn that you can ask your credit card providers for a higher credit limit.

Many credit card issuers are happy to give you access to more cash, especially if you have a proven payment history. So, if you are in good standing with your lenders, it might be as simple as a phone call to customer service.

As an example, let’s say you have a credit limit of $8,000 and a balance of $3,000 for a utilization rate of 37.5%. But you decide to give your credit card company a call to ask for a higher credit limit.

After a polite call, you receive the good news that your credit card limit has been increased to $15,000. With the same balance, you’ve lowered your utilization rate to 20%. That could make a major difference in your credit score.

Pay Your Credit Card Bill Off Early

Credit card issuers will report your balance to the credit bureaus once per month. Nothing is stopping you from making your credit card payment before they report the balance.

Take a closer look at the billing cycle for your credit card. If you can, pay off your credit card balance before the end of the statement cycle. If you pay off the balance early, it will look like you used less of your credit limit than you actually did.

Related: How To Maximize Credit Card Rewards & Promotions

Spend Less

An obvious solution to lower the ratio is to spend less. Unfortunately, this is easier said than done.

If you want to try this option, start by eliminating unnecessary expenses. You might be surprised by how much you can cut out of your monthly spending patterns. Plus, you can repurpose those funds to work towards other financial goals.

Take Advantage of Balance Alerts

The vast majority of credit card issuers will allow you to set up a balance alert. Take advantage of this feature if you are struggling to keep your utilization ratio in check.

Set up an alert once your credit card balance hits a threshold of your choosing. You can set the threshold at 30% to ensure that you keep your utilization within the appropriate bounds.

Leave Cards That You Rarely Use Open

With more open cards, you’ll be able to boost your total credit limit. As you pay down debt, consider leaving cards open to inflate your credit limit.

You don’t have to use the cards anymore, but it can be an option to help you lower your overall usage percentage.

Better yet, if you keep older cards open, you might be able to increase your length of credit history and give your score an extra boost.

The Bottom Line

If you want to pay down debt strategically to boost your credit score, Undebt.it can help. One of Undebt.it’s seven debt payoff plans is focused on credit utilization. It’s perfect for people who want to improve their credit scores.

Sign up for a free account with Undebt.it to get started today.