How to Maximize Credit Card Rewards & Promotions

When you maximize credit card rewards and promotions, you can help offset the cost of your purchases. It’s important to remember that you can only win this game if you can pay off your purchases in full so you aren’t hit with high interest payments.

From making sure you are getting 2% back on each purchase to watching rotating categories and more, here are my best tips to maximize credit card rewards and promotions.

My Rules for Credit Cards Rewards

Each persons’ debt situation is unique. There is no one-size-fits-all set of rules that work for everybody. However, I wanted to share the approach that I currently use. Here are the rules that I follow:

Rule #1: Buy Everything You Can Using a Credit Card

This sounds like bad advice, especially from the developer of a debt management tool, but hear me out. You can get some major benefits if you do it right.

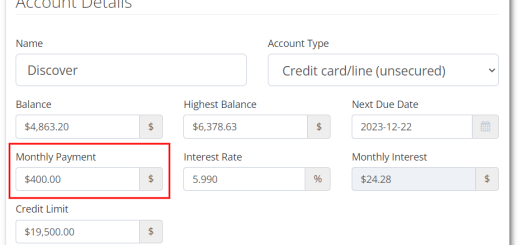

If you can get a separate set of credit cards for ongoing purchases (groceries, utilities, etc.), you can start getting ahead in the credit game. If you are doing balance transfers, I recommend using a dedicated credit card for those and not putting ongoing purchases on those cards.

Purchase discipline is critical because you have lost the credit game if you start carrying a balance for ongoing purchases. Here’s what I mean by purchase discipline:

- Only make purchases you would have normally made anyways using a debit card or check. In other words, treat your credit card just like a debit card and only spend the money that you already have allocated for the purchase. It’s too easy to buy things you don’t need with money that you don’t have when it doesn’t come out of your checking account right away.

- Always pay off the purchase quickly. I like to pay off the purchases as soon as they post so they don’t keep accumulating. This means I usually make a couple of payments each week. It’s also easier for me to reconcile my budget when there are multiple transactions throughout the month instead of one or two large payments. Be careful around the statement closing time since any open balances will show on your credit report. This can cause a brief drop in your score. It’s ok if the statement closes and you have a balance. Just make sure to pay it off so you don’t start accruing interest.

Now that the warnings are out of the way, there are plenty of benefits to using credit for purchases:

- Rewards: You can get cash back or points that can be used for travel and other expenses. These rewards can add up quickly and it’s free money. I don’t like leaving free money on the table. It’s best to decide early on which of these you prefer because it will affect which credit cards you will want to add to your wallet. I’ll go over this more shortly.

- Fraud & purchase protection: Credit cards offer some protection against card theft and illegal use that debit cards don’t. Disputes can easily be initiated on fraudulent transactions.

- Other benefits: Most cards offer other benefits, like extended warranties, price matching, and theft protection. Some even provide cell phone loss & damage protection if you pay your bill with your credit card.

Rule #2: You Should be Aiming to Get at Least 2% Cash Back on Each Purchase You Make

2% doesn’t sound like a lot of money. However, if you consider that the average American household spends over $5,100 each month, it can add up fast. Unfortunately, mortgages (which are usually the largest monthly expense) are difficult to earn cash back on. Most banks charge a fee for credit card payments that is over 2%.

Fortunately, it is pretty easy to get over 2% on category spending like groceries and restaurants. I have found it works best to have a few cards on hand and use them where they get the best results.

Here’s my current breakdown:

- Food & Groceries: Amex Gold card gets 4x Membership Rewards (MR) which I can redeem at 1.25x. So that effectively earns me 5% cash back on all food purchases.

- Gas: Citi Costco Visa earns you a whopping 4% gas. If you’re paying $3.00/gallon for gas in your area, this card brings that cost down to $2.88/gallon.

- Cell Phone, Cable & Internet: Chase Ink Preferred. This is a business card that earns me 3x Chase Ultimate Rewards (UR) points. It also provides cell phone insurance coverage as an added bonus.

- Travel: Amex Schwab Platinum gets 5x MR points plus other travel related benefits

- Amazon: Chase Amazon gets you 5% back if you are a Prime member. Otherwise, it’s 3%.

- Everything else: Amex Blue Business Plus is another business card I use. This one earns 2% MR on any purchase. Since I have an Amex Schwab Platinum, the points can get redeemed into cash at 1.25x, meaning that I am effectively getting 2.5% back on all purchases.

Note that some of the cards I use carry an annual membership fee. I will go over the pros and cons of premium cards in another article. There are some very good free (no annual fee) options you can use for category spending.

You don’t need to have all of these cards in your wallet at all times. Use the Apple Wallet or Samsung Pay to store multiple cards on your phone.

Related: Are Premium Credit Cards Worth It?

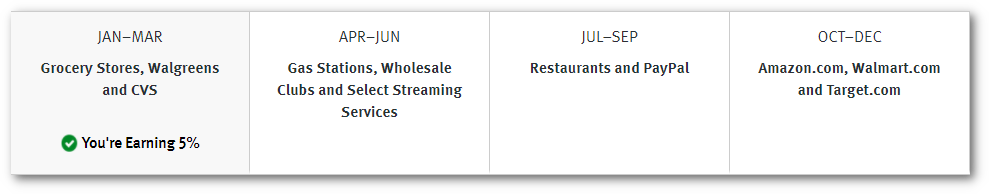

Rule #3: Keep Your Eye on Rotating Category Quarterly Bonuses

Some lenders offer quarterly rotating category cash back bonuses that can be very lucrative, especially around the holidays. You’ll want to keep an eye on these to maximize credit card rewards. Discover and Chase are the ones I deal with the most. Discover has had a 5% bonus at Walmart, Amazon, and Target for the last couple of years. You will have to turn these on for your account, but it’s easy to do and it’s free money. Every once in a while, there is a 5% bonus on Chase Freedom for Costco which I max out every time.

Rule #4: Look for Combo Cash Back Deals & Other Promotions

Whenever I make an online purchase, the first place I start is Rakuten. Rakuten is one of many cashback sites out there that let you earn additional cash back bonuses by clicking on their referral links. Rebates are the highest on Black Friday and at Christmas time.

If you are a fan of Samsung products, you’ll definitely want to look into this. I purchased a TV, multiple cell phones, and smartwatches from Samsung via Rakuten. This has earned me hundreds of dollars in rebates. These rebates can get as high as 30% off for Samsung. Better yet, you can stack with other promos and discounts.

Related: How to Earn Extra Cash with Bank Account Bonuses

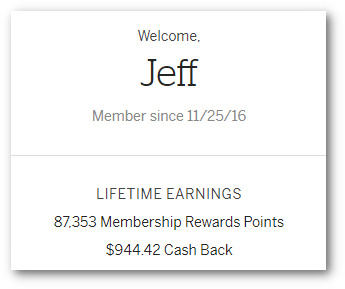

My Earnings

The screenshot below shows my lifetime earnings. My account is set to earn American Express MR points that I can redeem for tax-free cash at 1.25x, which comes out to $1,092. Adding in the cash back I earned prior to switching over to MR, my total earnings come in at over $2,000. This shows just how lucrative it can be when you maximize credit card rewards and promotions.

Affiliate link: Rakuten has a referral bonus going on right now where if you click on my link. We both get $20 when you make your first purchase over $20.

Here are a few notes on Rakuten and cash back sites in general:

- Privacy concerns: Rakuten uses browser cookies to track the purchases you make when you click on their links. It’s how they get paid by the vendors when you make a purchase. They do have a browser toolbar plugin that you can use. However, I just visit the site and click the links from there. I suspect the toolbar can track all of the sites you visit, so I opted to go the manual route.

- Not all sales get tracked: I have found that around half of my purchases don’t register and some action is required to get paid. Rakuten makes it easy to see if the visit got tracked and it’s really easy to get it resolved. The support bot on their site is top-notch. What works well for me is whenever I receive the product, I will check on the site to make sure it got tracked. If I’m making a big purchase with a big discount, I will take a screenshot of the redirection page just in case. It shows the ID number of the visit and the discount amount.

- Payout thresholds: You can go to a cash back aggregator like cashbackmonitor.com to shop around for the best current rebate, but be aware of payout thresholds. Typically, you only get paid after you have earned a certain amount of money. The minimum payout threshold for Rakuten is $5, but I have seen some sites as high as $50. I really don’t want to have my balances spread out over a few different sites. I like to keep it simple and just use one site.

Individual Card Promotions

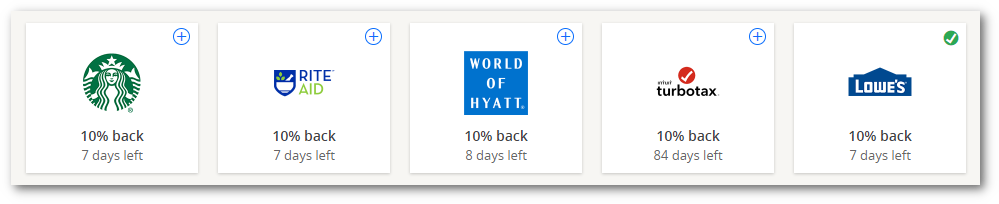

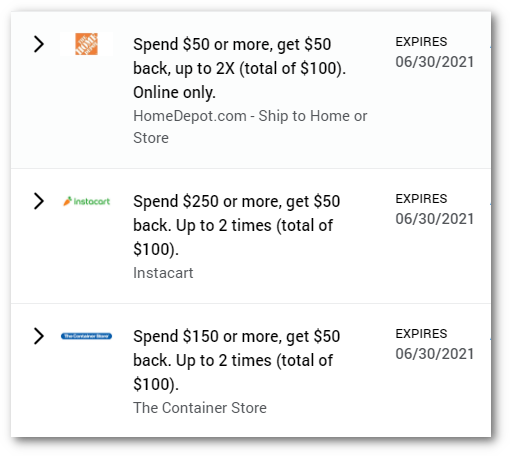

Most of the credit card companies I use also offer some pretty valuable promotions from time to time. You will have to log into your account and check to see what’s out there and also turn on the promo for your account. Doing this can net you some generous returns. Chase’s offers aren’t usually all that great, but there’s a gem every once in a while.

A lot of people could find some value in a 10% cash back from Lowes. These offers usually have a modest discount cap, so that’s one thing to keep your eye on. Each card will have its’ own set of promos, so you’ll want to check each one.

I’ve had better luck with American Express offers recently. There is also a $50 off of $50 (up to 2 times) for Best Buy, which I’m sure I can find a use for.

The premium credit cards will get the better offers, but there are some decent ones that pop up on free cards too. I try and check them once a week or so.

The premium credit cards will get the better offers, but there are some decent ones that pop up on free cards too. I try and check them once a week or so.

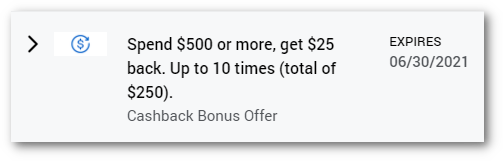

This Amex offer for $25 back on purchases over $500 will get some use too. I’m in California’s central valley where heating and cooling costs can get very high. It only costs me $1.35 in fees to pay my gas/electric bill with a credit card. My bills for the next few months will probably be around $450, so I’ll just pay a little extra to get me over the $500 threshold so I can score the $25 bonus and still net the $12.50 cash back bonus (2.5%). The credits will be used up when summer comes and the bill is over $500 anyway.

Stacking the Promos

The real magic happens when you use these methods in combination. These offers stack so you will get the full discount on the purchase.

For example, I recently bought a new Casper mattress online. I picked up an offer on my Chase Freedom card for $50 cash back on Casper.com. Next, I used the link on Rakuten for 5% cash back. I also looked around for the best promo code on the Casper site, so I was able to stack three different levels of promotions.

Final Words

Lastly, be sure to keep your eye on the fine print when you try to maximize credit card rewards and promotions. I have missed out on a few promos because I didn’t pay close enough attention to the details. Sometimes certain purchases won’t qualify. If you want to get into something really fun, I’ll be writing an article on credit card churning and bank account bonuses next month.