7 Types of Credit Cards; Choose the Right One

Credit cards are a helpful financial tool if you use them responsibly. Although they began as simple charge cards in 1950 designed for dining out, credit cards have evolved dramatically over time.

Today, there are many types of credit cards on the market, ranging from balance transfer cards to rewards cards and more.

If you are considering opening a credit card, it is a good idea to understand the most popular types of credit cards available to consumers to make sure you apply for the right one.

Types of Credit Cards

There are many types of credit cards currently on the market. Some can help you build credit or reduce your interest rates while you pay off debt, while others can score you rewards.

Here are some of the most popular types of credit cards available today.

Balance Transfer Credit Cards

These credit cards let you transfer your balance from a higher-interest credit card to one that has a lower introductory interest rate. This can be helpful if you are dealing with credit card debt.

You may have to pay a fee to transfer your balance, but you could save money on interest if you can pay off your card during the introductory period.

Secured Credit Cards

Secured cards are for people who don’t have great credit scores or are trying to build credit. They require a security deposit that is refundable and held until the account is closed. Your security deposit generally becomes your spending limit.

Rewards Credit Cards

There are many credit cards that reward you for using your card to make purchases. Here are some of the most common types of rewards credit cards.

Travel

Travel rewards credit cards are designed to provide cardholders with travel-based incentives. The exact rewards system will vary depending on the card.

For example, you may choose to use an airline company credit card that provides miles that can be exchanged for flights. Or you may opt to use a more broad travel rewards credit card to earn points that are redeemable for various travel purchases.

The good news is that no matter your travel preferences, there is likely a travel rewards credit card designed with your needs in mind.

Cash Back

Another popular reward credit card model is the cash back card. Essentially, you’ll spend money on a credit card and, at the end of each statement cycle, you’ll receive a percentage of cash back based on what you’ve spent.

This cash can be awarded in multiple ways, including a statement credit or check.

Some cash back credit cards will reward your spending based on particular categories. Others will provide a flat cash back option. You can choose a card that works with your spending patterns to maximize your rewards.

Points

A more general option for rewards credit cards are those that provide points. These may be redeemed for gift cards, merchandise, and more. These types of cards may also give you the option to redeem points for cash and travel rewards.

However, points cards give you more flexibility with what you can redeem your points for than cash back or travel rewards credit cards. For instance, some points cards might offer the opportunity to donate your points to charity.

Retail

Retailer cards are offered through particular stores. You can sign up for these credit cards online, or you could even sign up at the check-out counter of some stores in exchange for a discount on your purchase.

Generally, these cards give you extra rewards when you use them at that particular retailer. However, you may not get rewards if you use them at other stores.

Beware that the interest rates with these types of cards can be higher.

How Many Credit Cards Can You Have?

There are no legal limitations to how many credit cards you can have.

That said, it is a good idea to limit the number of credit cards in your wallet to avoid debt if you have trouble managing your credit responsibly. After all, the more credit cards you have burning a hole in your pocket, the more likely you are to overspend.

Of course, this is not the case for everyone. There are some extreme credit card rewards users that have dozens of credit cards in order to take advantage of the rewards system.

For example, you may decide to open a credit card to take advantage of the welcome bonus and keep it around just long enough to use the points.

Ultimately, the right number of credit cards will vary based on your situation and how comfortably you can stick to your spending limits.

Also, it is worth noting that some banks will not issue you a card if you have too many others open. A perfect example of this is Chase’s 5/24 rule. With this rule, Chase is unlikely to issue you a credit card if you open more than five cards in 24 months.

Related: 7 Effective Ways to Pay Off Debt Fast

What Type of Credit Card is Best For You?

The right type of credit card is different for everyone. Essentially, the appropriate credit card for your situation will depend on your goals.

Here are some things to ask yourself as you determine the best credit card for you:

- Do I need to build my credit?

- Am I trying to pay off debt?

- Can I pay off my card in full and on time each month?

- What kind of rewards would I benefit most from?

- Where do I do most of my shopping?

If you are trying to build your credit, a secured credit card may be the right fit for you. Or, if you have high interest debt, a balance transfer to a credit card with a lower APR could be the smart move.

Travel enthusiasts with good credit may prefer travel rewards cards to maximize your travel budget, while those who spend a lot at a certain store, such as Home Depot or Macy’s, may benefit from a retailer card.

Take some time to explore your options before moving forward with a particular type of credit card, and remember that you are the one who is best equipped to decide which card is right for you based on your unique financial situation.

The Bottom Line

Credit cards can help you stretch your dollars further. With many credit card choices available, you can likely find a card to suit your needs.

Regardless of if you want to improve your credit score, enjoy cash back rewards for your spending or beef up your vacation budget with travel rewards, a credit card can be a helpful resource.

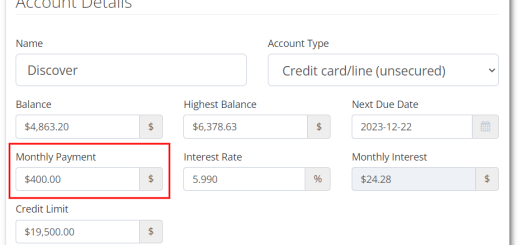

However, credit cards can become a problem if you are unable to make on-time monthly payments. If you need help eliminating your credit card debt, Undebt.it has free resources and tools to help you pay off your credit card debt.