Shaking Up the Debt Snowball with a 401(k) Loan

An Aggressive Approach to Paying Down Debt and Increasing Your Debt Snowball

I’ve been doing a pretty good job of paying down my debt and building up the debt snowball over the past few years. Unfortunately I still have over two years to go. I tend to change between payoff methods every so often depending on circumstances.  I initially started out strictly using the debt snowball method on the smaller accounts and it works great for that. However, from a mathematical standpoint, the debt avalanche method will get you better results – paying less in total interest for example. Other factors, like the need to quickly improve my credit score, brought me to the choice to get a 401(k) loan and pay off certain debts on one shot.

I initially started out strictly using the debt snowball method on the smaller accounts and it works great for that. However, from a mathematical standpoint, the debt avalanche method will get you better results – paying less in total interest for example. Other factors, like the need to quickly improve my credit score, brought me to the choice to get a 401(k) loan and pay off certain debts on one shot.

Risks vs. Benefits

Of course, there is no such thing as a free lunch and this approach is no different. There are a number of things you need to think through before proceeding. The most import thing is that your job needs to be secure. If you or your employer terminate your job, you will be required to pay back the loan, typically within 30-60 days of termination or it will be treated as taxable income plus the 10% early withdrawal penalty. Here are the factors you need to carefully consider:

| Pro | Con |

| Very low interest rate, 4.25% in my case | You don’t earn any gains on on your loan amount |

| You pay the interest back to yourself, not the bank | If you lose your job, the loan is due in full. If you can’t pay it back, it will become taxable and will be subject to early withdrawal penalties. |

| You don’t pay taxes on the loan | Any interest paid on the loan is not deductible |

| Does not show as a loan on your credit report | Your employer may need to approve your loan |

Another thing you need to check on is if there are any restrictions or penalties for early payoff. Some loans may not allow additional payments. You will definitely want to pay this off early as part of your debt snowball. If you can’t early or additional payments, you’ll want to setup a separate savings account where you can stash any snowball payments.

What Would Dave Say?

Mr. Ramsey is not a fan of touching your 401(k) plan except to avoid bankruptcy or foreclosure – this includes 401(k) loans. He feels that there is too much risk involved in taking out a loan that will become due in full at the worst possible time – the loss of your job. While he is absolutely correct that there is a substantial risk involved I feel that you should treat this as a leveraging of your assets to help eliminate your biggest financial enemy, debt.

Mr. Ramsey is not a fan of touching your 401(k) plan except to avoid bankruptcy or foreclosure – this includes 401(k) loans. He feels that there is too much risk involved in taking out a loan that will become due in full at the worst possible time – the loss of your job. While he is absolutely correct that there is a substantial risk involved I feel that you should treat this as a leveraging of your assets to help eliminate your biggest financial enemy, debt.

Crunching the Numbers

Before moving forward, I looked at the numbers and weighed the risks. Employment seems pretty solid for both of us at this point. We’d be saving a bunch of money in interest every month. Lower monthly payments would give us more flexibility with our income. Paying off some of the credit cards would help our FICO score. Once we decided to go forward, the next step is deciding which debts to pay off. Here’s an approximate “before” look at my debt list in order of my previous payoff plan:

| Loan | Balance | Credit Limit | Payment | Interest Rate | Monthly Interest | |

| 1. | Credit Union Line of Credit #2 | $2,953 | No Credit | $360 | 13.0% | $32.00 |

| 2. | Credit Card #1 | $3,967 | $4,800 | $85 | 16.25% | $53.72 |

| 3. | Credit Union Line of Credit #1 | $3,692 | $5,000 | $85 | 10.0% | $30.77 |

| 4. | Credit Card “A” | $3,395 | Closed | $70 | 12.5% | $35.37 |

| 5. | Credit Card #2 | $6,156 | $6,600 | $105 | 9.24% | $47.41 |

| 6. | Auto Loan | $10,905 | n/a | $304 | 5.0% | $45.44 |

| 7. | Credit Card “B” | $8,807 | Closed | $185 | 9.25% | $67.89 |

| 8. | Credit Card #3 | $5,845 | $8,000 | $80 | 4.0% | $19.49 |

| $45,720 | $24,400 | $1,274 | $332.09 |

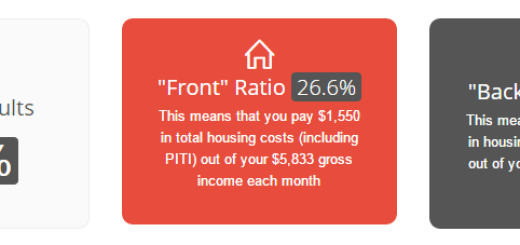

That’s a pretty brutal list that doesn’t leave a lot of room for flexibility. High monthly payments, lots of interest paid. Also, the very high credit utilization and debt-to-income ratio is killing my credit score. Basic payoff format was the debt avalanche with an exception or two. The current payoff date is February 2016.

Picking the Debts

After trying out a few different scenarios, I decided to pay off certain debts out of order. The mix I ended up with was a debt with a high monthly payment and high interest rate (the $360 line of credit loan), and three debts that would help my credit rating (the two credit cards and the active line of credit loan). These are the ones I decided must go!

| Loan | Balance | Credit Limit | Payment | Interest Rate | Monthly Interest |

| Credit Card #1 | $3,967 | $4,800 | $85 | 16.25% | $53.72 |

| Credit Card #2 | $6,156 | $6,600 | $105 | 9.24% | $47.41 |

| Credit Union Line of Credit #1 | $3,692 | $5,000 | $85 | 10.0% | $30.77 |

| Credit Union Line of Credit #2 | $2,953 | No Credit | $360 | 13.0% | $32.00 |

| $16,768 | $16,400 | $635 | $163.90 |

Here’s the “after” list in (temporary) new payoff order:

| Loan | Balance | Credit Limit | Payment | Interest Rate | Monthly Interest |

| Credit Card #3 * | $5,845 | $8,000 | $80 | 4.0% | $19.49 |

| Credit Card “A” | $3,395 | Closed | $70 | 12.5% | $35.37 |

| Credit Card “B” | $8,807 | Closed | $185 | 9.25% | $67.89 |

| Auto Loan | $10,905 | n/a | $304 | 5.0% | $45.44 |

| 401(k) | $17,000 | $17,000 | $240** | 4.25% | $61.63 |

| $45,952 | $25,000 | $879 | $229.82 |

* I chose to move credit card #3 to the top of the list for a month or two to get it paid down so my credit utilization will be under 30% (down from over 80% where it was sitting) ** Payment amount is approx. $120 per biweekly paycheck. I budget for 2 paydays per month, however, 2 times a year there are 3 paychecks so average monthly payment with that factored in is approx. $260.

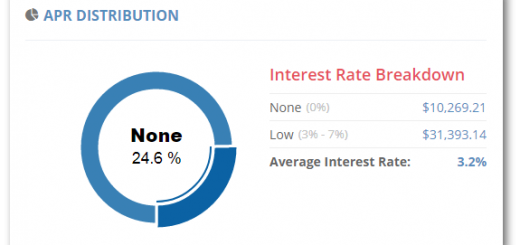

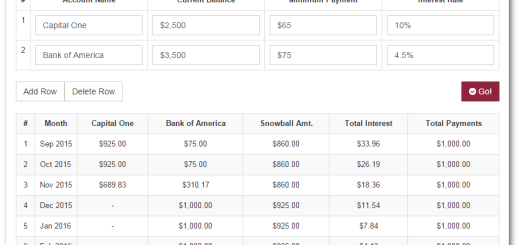

You can see that this changed things up quote a bit. $100 a month in interest saved right off the top. Actually, I saved $163.90 a month in interest if you take into consideration the fact the you keep the $61.63 in interest paid into 401(k) loans – you are effectively paying yourself interest on the loan. The other big change is the to the monthly debt snowball amount. Before the loan, my snowball amount was a mere $146. Now that these debts are paid off, my debt snowball amount is much more appealing $521. The third big bonus of this whole ordeal is my credit rating stands to get a healthy boost as well. I’m documenting that part the process in another post, the credit jumpstart project. The payoff date doesn’t change a whole lot, around 1-2 months in my case, but the savings in interest and the boost to the credit rating is why I chose to go this route. The exposure window on this loan is relatively short – just over two years as part of my debt snowball. Obviously, the longer you take to pay back the loan, the larger the risk window, so pay it off just like any other debt on your plan. This approach is not for everyone, but it’s still an option you should look into if you find yourself in a similar situation.