Debt Snowball vs. Avalanche: Which One?

If your debt is holding you back, you need a strategy to deal with it.

There are two main approaches for paying off debt: the debt avalanche and the debt snowball. Both methods help you achieve freedom from debt; however, deciding which path is right for you can be challenging.

To help, here’s everything you need to consider about the debt avalanche and debt snowball methods.

Debt Snowball vs. Debt Avalanche

Both the debt snowball and the debt avalanche require paying the minimum payments on all your debts except one. To that one debt, you’ll pay as much extra as possible until it is gone. Once that debt is paid off you move on to the next debt, and then the next, and so on until you are debt-free.

The difference between the debt snowball and the debt avalanche is the order you pay your debts. In the snowball method, you focus on the smallest balance first. In the avalanche method, you focus on the debt with the highest interest rate first.

It’s easier to stay motivated with the snowball method since you can knock out a bunch of small debts fairly quickly. While the avalanche method saves more money in interest.

| Debt Snowball | Debt Avalanche |

| Focuses on the smallest debt | Focuses on the debt with the highest interest rate |

| Can reduce stress quickly since you’ll pay off your small debts quickly | Mathematically should save you the most money |

| Can make it easier to stay motivated | Can require a lot of discipline |

What Is the Debt Snowball?

The debt snowball approach focuses on paying off the smallest debt first. Once it’s out of the way, you move on to paying off the next-smallest debt, and so on. Addressing the smallest debt first gives you a good feeling early on. From there, each debt you eliminate feels like a weight off of your shoulders, and it motivates you to “stick with the program,” even when it’s hard work.

Related: What is The Debt Snowball?

How Does the Debt Snowball Work?

Here’s an example. Let’s say you have three debts. You have $500 a month above the minimum payments to send towards your debts. Where do you put it?

| Product | Balance ($) | Interest Rate (%) |

| Credit Card 1 | 5,000 | 10 |

| Credit Card 2 | 12,000 | 25 |

| Car Loan | 25,000 | 5 |

With the debt snowball, the answer is easy. Your lowest balance is $1,500, so that’s where your $500 goes.

With the snowball method and an extra $500 per month, this person would be debt-free in 39 months and pay $6,795.49 in interest.

What Is the Debt Avalanche?

The debt avalanche approach focuses on paying off debts with the highest interest rates first. Addressing the most expensive debt first saves you the most money on interest costs. You can then apply these savings toward your principal, hence saving yourself even more money.

Related: What Is the Debt Avalanche?

How Does the Debt Avalanche Work?

Using the same scenario, let’s say you have three debts and an unexpected windfall of $500. Where do you put it this time?

| Product | Balance ($) | Interest Rate (%) |

| Credit Card 1 | 5,000 | 10 |

| Credit Card 2 | 12,000 | 25 |

| Car Loan | 25,000 | 5 |

In this case, the extra $500 would go towards Credit Card #2 first since it has the highest interest rate.

With the avalanche method and an extra $500 per month, this person would be debt-free in 38 months and pay $5,790.46.

The avalanche method saves them one month and $1,005.03 in interest.

However, it’s very motivating to start making significant progress on the smallest debt rather than have it hanging around for years while you work on the larger credit card. Knocking out those little debts (especially if you have several of them) can be kinda fun and it certainly can reduce the stress of getting the mail.

Does It Matter Which You Use?

It really doesn’t matter which method you use as long as you stay motivated. Paying off the debt is the important part. As you can see from the example above, the difference in order is fairly small. Yes, $1,000 in extra interest is worth considering, but if making big progress on your smaller debt means you stick with the plan then it’s worth paying some extra interest.

The worst-case scenario is quitting and staying in debt.

If you want to use the snowball method but letting that high-interest rate debt just sit there look into ways to reduce the interest rate — such as doing a balance transfer or refinancing the debt.

Related: 7 Effective Ways to Pay Off Debt Fast

The Importance of Your Credit Score

If you are simply going to pay down your debts as they currently stand, then, mathematically, you could save a fair bit of money by using the debt avalanche approach rather than the debt snowball approach. However, in the real world, it generally makes a lot of sense to switch to more attractive debt products as soon as you are able.

Your credit score impacts what financing products are offered to you and when. Many factors affect your credit score. One factor is your debt to credit ratio. Which is calculated by how much credit you have available to you in comparison to how much you owe. For example, if you have a $2,000 line of credit and owe $1,000 on that card, you have a debt to credit ratio of 50%. The lower ratio the better.

So, paying off the $5,000 balance can give your credit score a respectable boost.

Another factor in your credit score is how old your accounts are. If you’ve had a credit card for 10 years closing it will have a greater impact on your score than closing one that you’ve only had for 1 year. So whether you actually close the account or not is up to you and how it will affect your credit score depends on your exact situation.

However, if you do close the credit card, you’ll have removed a potential source of temptation. If you don’t have a credit card, you can’t make purchases and acquire more debt. If this is a struggle for you it’s worth closing the account even if it hurts your credit. Staying out of debt is more important than a few points on your credit score.

The Undebt.it Debt Calculator

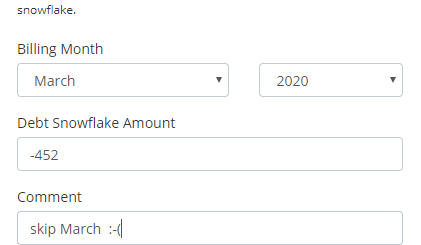

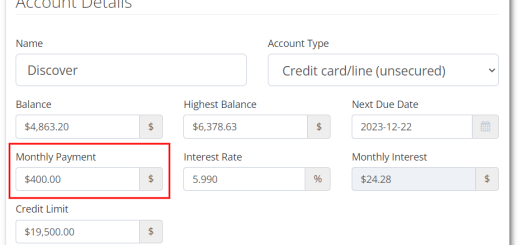

Here at Undebt.it we have a free, mobile-friendly, debt snowball calculator that does all this math for you.

You enter your debt information and you can choose from seven different pay-off methods, including the snowball, avalanche, or a totally custom order. You can also change the order at anytime if you want to mix things up.

Once you’re set up, you can use the calculator to record your payments and keep track of your snowball so you can see exactly how much progress you are making and when you’ll be debt free.

Talk about motivating! Learn more about the calculator here.

Debt Avalanche vs. Snowball: Which Is Right For You?

Both the debt avalanche and the debt snowball approaches work on the same basic principle: They help you pay off your debt so that you can put your money to work for you instead of making monthly payments to others. The strategy that is right for you is the one that will keep you the most focused and motivated to keep going. Just pick one and start working towards becoming debt free.

A great article, thanks!