Another Debt Paid Off (with some help from a debt snowflake)

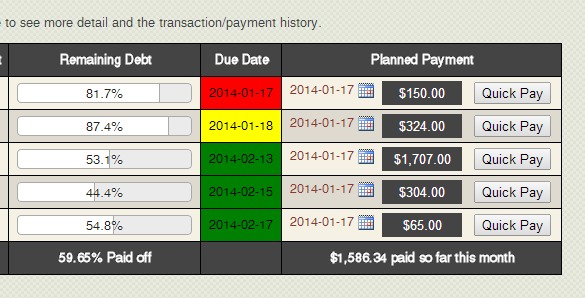

I just got back from the bank where I wrote a check for the payoff balance of one of my last credit cards. It was a card with a 12.5% interest rate and the highest balance was close to $5,000. Looking back through my payment history from years ago, I see that I was paying over $100 per month on this one card alone. Needless to say, it’s a pretty good feeling being able to wipe out one more obstacle on my way to debt freedom. What made it a little easier was that extra paycheck we get this month. This gives me chance to go over a particular feature of Undebt.it that you may not be aware of, the “additional payments” section located under the My Debts menu item.

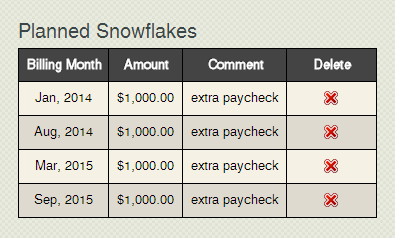

The additional payments, or debt snowflakes as some people come them, allow you to account for any extra income you may be able to apply towards a debt in a certain month. Since we get paid three times this month, I try and plan to earmark an extra $1,000 to put towards debt. It’s also a good time to make sure your emergency fund is in the black. These extra payments can make a big difference in your plan. Without them, it would take me an additional four months to be debt free.

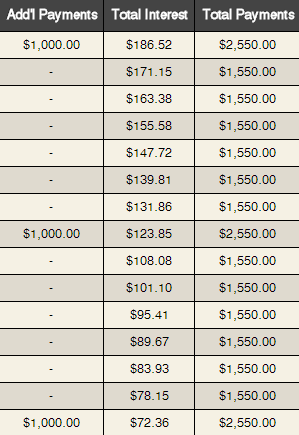

The additional payments, or debt snowflakes as some people come them, allow you to account for any extra income you may be able to apply towards a debt in a certain month. Since we get paid three times this month, I try and plan to earmark an extra $1,000 to put towards debt. It’s also a good time to make sure your emergency fund is in the black. These extra payments can make a big difference in your plan. Without them, it would take me an additional four months to be debt free.  This next screen shows how the debt snowball table handles these extra payments.

This next screen shows how the debt snowball table handles these extra payments.

You’re not limited to just adding one additional payment per month – you can add as many as you want and Undebt.it will total up the payments. You can even add a negative amount to bring down snowball payment for a month if needed. For example, if you know you’re going to have a property tax bill coming up in April, just add a negative additional payment so your budget will be more accurate.