What Is the Debt Avalanche?

Paying off debt can feel overwhelming, but putting together a debt payoff plan can help break it down into smaller, actionable steps. One of the most popular payoff plans is the debt avalanche.

This debt payoff method focuses on eliminating your highest-interest debt first. But what is the logic behind the debt avalanche? Is it the best way to pay off your debt?

How the Debt Avalanche Method Works

The debt avalanche method is a debt payoff strategy that prioritizes paying off your highest-interest debts first. The idea is that focusing on paying off the debt with the highest rates will save you the most money in the long-run.

If you have multiple debts, the goal is to put them in order, with the highest-interest debt being paid off first. For all other debts, simply pay the minimum payment to stay current.

How to Pay Off Debt Using the Debt Avalanche Method

Using the debt avalanche to pay off debt is a four-step process. Follow these steps to put together your own debt avalanche.

Step 1: Make a List of All Your Debts

Start by making a list of all of your debts. This includes credit cards, car loans, student loans, personal loans, tax debt, or any other debt you owe.

Note: Most people will NOT include their mortgage in the debt avalanche. Since a mortgage is typically a much higher balance than consumer debts and is attached to an appreciating asset, the mortgage should typically be paid off last.

When listing your debts, make sure to include the name, total balance, minimum payment, and interest rate.

Step 2: Put Debts in Order from Highest Interest Rate to Smallest

After you have a complete list of your debts, put them in order from highest-interest date to lowest, top to bottom. This is the order you will pay them off.

You’ll only pay the minimum payments on your other debts. This allows you to maximize your payments toward the most expensive debt on your list.

Here’s what your debt avalanche may look like:

| Debts | Total Balance | Min. Payment | Interest Rate |

| Visa | $ 10,000.00 | $ 350.00 | 26.00% |

| Mastercard | $ 6,000.00 | $ 240.00 | 22.00% |

| AMEX | $ 7,000.00 | $ 280.00 | 18.00% |

| Student Loan | $ 85,000.00 | $ 900.00 | 5.00% |

| Car Loan | $ 30,000.00 | $ 520.00 | 4.00% |

Step 3: Pay off Highest Interest Debt First

The key to the debt avalanche is total focus on only paying off one debt at a time. Take every extra dollar you come across and pay it toward the high-interest debt at the top of your list.

This will help you pay off this debt quicker than using your extra payments on other debts.

Step 4: Repeat

Once you pay off your first debt, repeat the process. The minimum payment you were paying on that debt is now available to add to your next debt. This causes an “avalanche” of extra funds to pile onto your debts, speeding up your debt payoff date.

Here’s what that looks like as you pay off each debt:

| Debts | Total Balance | Min. Payment | Interest Rate | Total Payment |

| Visa | $ 0 | $ 350.00 | 26.00% | $ 350.00 |

| Mastercard | $ 6,000.00 | $ 240.00 | 22.00% | $ 590.00 |

| AMEX | $ 7,000.00 | $ 280.00 | 18.00% | $ 870.00 |

| Student Loan | $ 85,000.00 | $ 900.00 | 5.00% | $ 1,770.00 |

| Car Loan | $ 30,000.00 | $ 520.00 | 4.00% | $ 2,290.00 |

As you can see, after the first debt is paid off, the $350 minimum payment is added to the next debt’s $240 minimum payment, giving you $590 per month to throw at the next debt. Then, after the second debt is eliminated, the $590 total payment can be added to the $280 minimum for the third debt so that you are making $870 payments each month.

Essentially, after each debt is paid off, the total amount you have to pay off the next debt becomes larger and larger.

This helps you pay off debts quicker, as well as save money on interest in the long-term.

Related: Cash Flow Index (CFI) Debt Payoff Method

Debt Avalanche Pros & Cons

The debt avalanche is a great way to pay off your debt, but it’s not perfect. Here are a few pros and cons of using the debt avalanche to pay off your debt.

Pros

- Mathematically saves you the most in interest

- Focuses on paying off one debt at a time

- Debt payments get bigger as you pay off each debt

Cons

- May lose motivation if paying off high balance debt first

While the pros outweigh the cons, keep in mind what will keep you motivated to pay off your debts. If saving on interest is motivating, the debt avalanche may work for you. Otherwise, if you need quick wins to stay motivated, a different debt payoff method may be better.

Is the Debt Avalanche Better Than the Debt Snowball Method?

The most popular method for paying off debt is the debt snowball method. It focuses on paying off the debt with the lowest balance, helping you pay off individual debts faster.

The debt snowball ignores interest rates and instead focuses on the psychology of “quick wins” to keep you motivated. As your debts get paid off, your minimum payments “snowball” onto themselves to speed up your payoff.

The debt avalanche focuses on interest rates, and mathematically you will pay less in interest by paying off debt this way.

But which method is better?

Short answer: It typically doesn’t matter.

Comparing both debt payoff methods will yield slightly different results. However, outside of substantial debt balances ($100k+), the difference in interest saved is usually small compared to the total debt paid off.

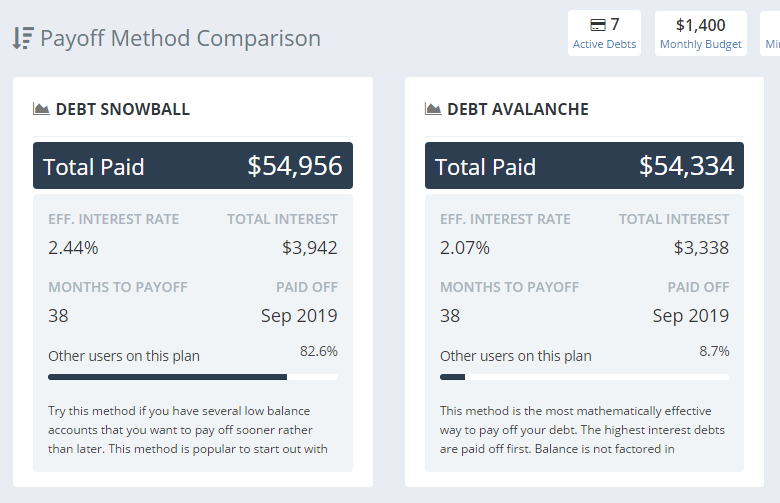

Using the Undebt.it tool allows you to compare debt payoff plans. In most cases, the difference in interest saved is negligible.

Here’s an example:

As you can see, paying off over $50,000 across several debts has the same debt payoff timeline and only saves a few hundred dollars in interest.

So, should you choose the debt avalanche or the debt snowball?

Honestly, it’s up to you. The key is to pick a plan that focuses on paying off one debt at a time. Stay consistent, and you will become debt-free!

Related: 7 Effective Ways to Pay Off Debt Fast

Compare Up To 7 Debt Payoff Plans with Undebt.it

While the debt avalanche and debt snowball are the two most popular ways to pay off your debt, they are not the only methods available. In fact, Undebt.it allows you to choose between up to seven debt payoff methods, each with its own advantages.

Outside of the two most popular options, here are five more to choose from:

1. Debt Hybrid (Debt-to-Interest Ratio)

This is a combination of the debt avalanche and debt snowball. You sort your debts by debt-to-interest ratio. To calculate the ratio, simply divide the total debt by the interest rate.

Example: $10,000 debt with a 12% rate = 833 DTI ratio

Calculate the ratio for all debts, and pay them in order, lowest ratio to highest. This allows you to pay off higher-interest debts but with lower balances to stay motivated.

Learn more about the Hybrid Method here.

2. Highest Monthly Payment

This debt payoff method organizes your debt payoff by the highest monthly payment first. It works best for those who want more cash flow in their monthly budget.

Debts like car loans and personal loans may have lower balances but still have a very high monthly payment. Paying these off first helps free up the most monthly cash, giving you more flexibility in your monthly budget.

3. Highest Credit Utilization

If you are looking to protect (and increase) your FICO score, the High Credit Utilization method will help. This method organizes your debt by analyzing debt accounts that are closest to their maximum credit limit.

Paying off your debts that are closest to their maximum limit allows you to reduce your “credit utilization,” which is a huge factor in determining your overall credit score. If you want to improve your score quickly, consider using this method.

4. Highest Monthly Interest Paid

This method is very similar to the debt avalanche but calculates the total interest paid on each debt. It then organizes your debt by the one that pays the most to interest each month.

Paying off your debt with the highest interest paid (total amount) will eliminate your most expensive debt first, freeing up cash flow and saving a ton on interest in the long run.

5. Custom Debt Payoff Plan

If you want to create your own custom plan, Undebt.it gives you full control over your debt payoff plan. You can organize and sort your debts to pay them off in any order you’d like.

You can switch between plans and see which one would work best for you. Check out the video below to learn how to compare debt payoff plans:

Debt Avalanche Summary

The debt avalanche is a solid debt payoff plan, but it’s not the only option available.

The keys to success in any debt payoff plan are focus and consistency.

If you want help putting together a plan that will keep you accountable and show you exactly when you will be debt-free, check out Undebt.it (for free).