Financial Literacy For Kids: Teaching Kids About Debt

Prioritizing financial literacy for kids can help them build lifelong skills that will allow them to manage their money effectively as adults. Most money lessons are simple, such as finding the best price at a grocery store or showing them how saving money every month can add up over time.

However, lessons such as teaching kids about debt can be tougher to teach. Helping kids understand what debt is, how to avoid it, and how to use it wisely to ensure they don’t get trapped by it is critical.

We’ll cover the basics of teaching your kids about debt so you can set them up for financial success.

Why It Is Important To Teach Kids About Debt

According to the FTC, there is over $4 trillion in consumer debt in America.

Yes, trillion with a “T.”

Student loans total nearly $1.7 trillion, auto loans over $1.2 trillion, and revolving debt (i.e. credit cards) over $750 billion. These mind-blowing numbers mean that most American adults owe over $12,000 in debt.

If we want to keep kids from burying themselves in consumer debt, we need to focus on financial literacy for kids and show them that there is a way to live life without borrowing for every major purchase.

Important Debt Lessons for Kids

When it comes to teaching kids about debt, here are a few lessons you can help them learn.

1. Why Debt is Common

Learning about debt should go back to the beginning of how it started in the first place. No, this doesn’t mean you need to go back through U.S. history to find its origins. However, it is important to talk about how it became normalized in today’s society.

Car loans first appeared about 100 years ago, and credit cards came out in the 1950s. Both of these types of debt allowed Americans to buy a car or product they didn’t have the money for, paying back the loan or card over several years with small monthly payments.

Today, debt has become commonplace. It has even been referred to as “the American Way” by the Journal of Consumer Research.

Using debt to purchase what we cannot afford is “normal.” Teaching your kids that debt is used by most Americans can help keep them aware that living debt-free may feel like they are being counter-cultural. Because, in fact, they are.

Related: What is Tax Debt? How Can I Pay It Off Quickly?

2. How Debt Can Hurt Their Future

Understanding that debt is normal is helpful. However, teaching kids about debt in a way that shows them its negative impacts can help them realize what it can do to their finances and their future.

Showing kids examples of the true cost of financing a purchase can be eye-opening. Here are a couple of scenarios that can help.

New Car Loan

Most Americans have auto loan debt. A recent study by Experian showed that 85% of all new vehicle purchases are financed.

New car loans are over $32,000 on average. A five-year term will cost the borrower an average of almost $4,000 in interest alone. In addition, new cars depreciate at a rate of 10% a year for the first five years.

The total cost of the $32,000 new car is just under $36,000 after five years, and the total value of that car is only $16,000.

Showing your kids that a car can cost them $20,000 within the first five years of owning it is a powerful lesson.

Credit Card

Credit cards have become normalized in American society, with average credit card balances currently at over $5,000. With average interest rates above 16%, credit cards cost households a lot of money.

Your kids might not qualify for a credit card for a long time. That said, when you start teaching kids about debt, it is important that they understand how quickly credit cards can get them into trouble.

If we take the average $5,000 balance and 16% interest rate as an example, this means that the average credit card holder is paying almost $65 per month in interest. Using a typical interest + 1% repayment schedule, paying this card off using just the minimum payment would take 269 months and cost over $6,000 in interest alone.

This would also require the credit card holder to stop using the card and pay for everything with cash or a debit card. The more likely scenario is continued minimum payments and an ever-increasing balance.

Showing your kids the trap that credit cards can become is a powerful motivator to stay debt-free and avoid them when possible.

3. The Power of Compound Interest

When it comes to financial literacy for kids, compound interest is usually talked about in regards to long-term saving and investing as a way to build wealth. But equally as important is the negative power of compound interest in regards to debt.

Start by showing kids how compound interest works in a positive light. Then show them how debt does the opposite by using compounding against them.

How Compound Interest Works

Compound interest is the process of earning interest on an investment, then reinvesting that interest into your investment. Then you continue earning interest on that higher balance, continuing the cycle of compounding your returns to grow at an exponential pace. This turns even the smallest amount into large amounts over time.

Example: If you invest $100 into an index fund at 10% growth, that fund will pay $10 in the first year. You now have $110 invested at 10%, and in year two, the investment earns $11. The returns grow year after year as the interest compounds.

This is a great way to grow your wealth.

How Debt Uses Compound Interest Against You

Lenders make money by charging you interest on your debt. That interest can compound on itself, just like an investment.

Unfortunately, many types of debt don’t just compound annually. They compound monthly or even daily. This keeps your balance from going down and forces you to pay more interest over the life of the debt.

Example: If you have a $5,000 credit card balance at a 16% interest rate and are only making a 2% minimum payment, the interest alone is more than the principal you pay. This means that your balance will not go down by much.

Here’s what the first few payments could look like:

| Month | Minimum Payment | Interest Paid | Principal Paid | Remaining Balance |

| 1 | $100.00 | $66.67 | $33.33 | $4,966.67 |

| 2 | $99.33 | $66.22 | $33.11 | $4,933.56 |

| 3 | $98.67 | $65.78 | $32.89 | $4,900.67 |

As you can see, almost two-thirds of your payment is going toward interest each month. This keeps your balance much higher, and each subsequent month charges interest on that balance. This is why compounding debt can keep people stuck and make them pay thousands in interest on even a relatively small balance.

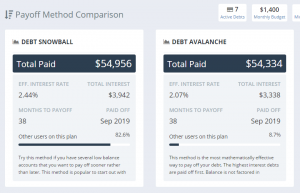

If you want to visualize how much debt can cost, you can plug in an example to the Undebt.it debt repayment tool. It will show how much interest you might pay and how long it would take to pay off the debt.

Teaching your kids that a $5,000 credit card balance can cost them more than $10,000 to pay off is a powerful example!

4. Good Debt vs. Bad Debt

Yes, debt can destroy your financial future. That said, some forms of debt can be leveraged for financial gain. Understanding that different types of “good debt” and “bad debt” exist can help kids make informed financial decisions.

Here are a few common types of debt and how to classify them.

Consumer Debt

Consumer debt is amounts owed for financing the purchase of consumer goods or items. This can include credit card debt, auto loans, store cards, personal loans, or other borrowed funds.

In most cases, consumer debt is considered “bad debt” since it is tied to items that do not go up in value. In fact, most of the purchases that cause consumer debt go down in value, making it a double-whammy to your finances.

Consumer debt also has higher interest rates than most other debt. These make it one of the worst types of debt to have.

Student Loans

Student loans are funds borrowed from the government or a private lender to pay for the costs of college. They can qualify as either good or bad debt based on how they are used.

If they are used to get a degree that earns enough to pay them off and substantially grows a person’s income ability over their career, they can be good. If they are used to pay for college without the ability to earn an income to pay them off, they are bad debt.

Considering student loan debt is now larger than auto loans and credit cards, it’s safe to say that student loans have gotten out of control. While many may be able to get a job in a high-paying field to pay them off quickly, many are in default. In fact, over 10% of all student loans were 90 days delinquent before the pandemic (which halted defaults).

No matter which camp you are in, student loans must be used with caution and a plan in place.

Home Loans

Home loans are widely considered to be good debt. They give borrowers the ability to purchase a home with a down payment instead of saving hundreds of thousands of dollars.

Since home values typically increase over time, you are purchasing a large asset with your loan. With interest rates at all-time lows over the past few years and the ability to write-off interest and property taxes, purchasing a home with a mortgage is considered a good investment.

But home loans can also put homeowners in a tough position. In 2008, homeowners were stretched beyond their means with terrible mortgage terms. When these loans started to fail, millions lost their homes. This goes to show that even “good” debt can have major consequences if not handled correctly.

Related: 6 Common Types of Debt

Summary

Most of us want our kids to enjoy a debt-free lifestyle, especially those of us who have seen the ugly side of what debt can do to our finances. Teaching kids about debt will help set them up for a more financially healthy life.

Teach your kids the basics, tell them your own story, and show them how to save for what they want. Doing this will put them further ahead financially than most of their peers. Raising debt-free kids is possible, and it starts by making financial literacy for kids a priority.