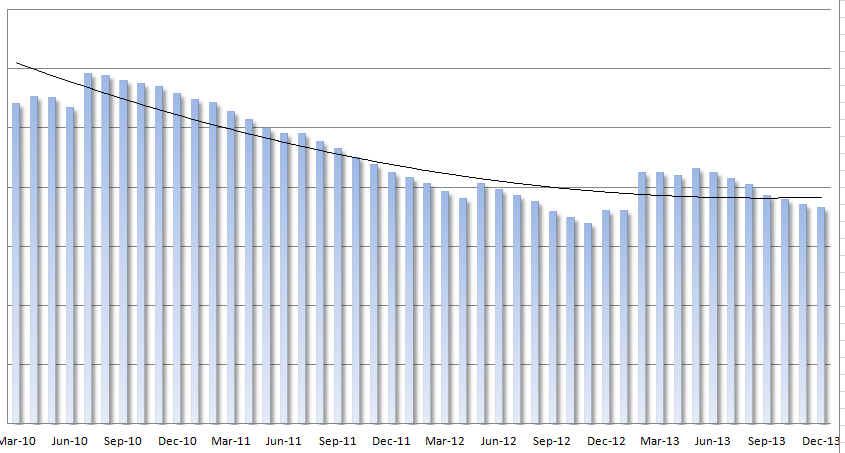

My Debt Snowball Progress Over Time

I’ve been working on paying down my debt for close to 4 years using a combination of different methods like the debt snowball, debt avalanche as well as variations of the two. I’m a “numbers guy” and I like to keep track of progress and history. It helps me visualize how far I’ve come in my battle to be debt free.

As you can see, I’ve had my share of ups and downs during this time. I had a great run in there from the middle of 2010 to early 2012. Even the tough months like December showed improvement. Recently, however, is a different story. Lost of inconsistencies have really done a number on the debt snowball trend-line. Some of these problems were the result of poor planning and some were unavoidable patches of bad luck. I look at this graph every month to make sure that trend-line gets straightened out back in a downward direction.

Two years ago I was paying around $1,325 per month in minimum payments plus $420 per month in interest alone. Stop and think about that – that’s more that what most people people pay for a mortgage on a very nice house. That money has been wasted and is gone forever. Today, my minimum payments total $1,060 per month plus just over $200 per month for interest. I look forward to the opportunities and flexibility I’ll have with all of that freed up cash in a couple more years.

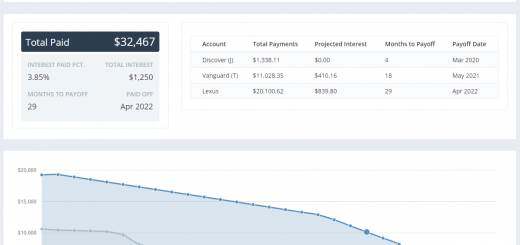

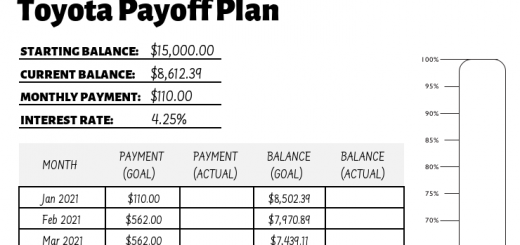

I’ve been taking monthly snapshots of the progress of your accounts as well. I hope to add some functionality in the neat future that will look something like this for you. Maybe it will help keep you motivated to keep that debt snowball moving downhill.

Love that downhill slope! Great job!