Leveraging Your Credit to Get Out of Debt

“I Thought Credit Cards Are Bad?!”

Some people think so *cough-Dave Ramsey-cough*, but I sure don’t. Used correctly, credit cards can be a very valuable tool that can be used to help eliminate your debt. They can also make you some cash and other rewards like travel points.

The Basics of Leveraging Credit

There are a few simple rules I like to follow when dealing with credit cards. Each family has their own set of unique circumstances so there is no one-size-fits-all solution, but there is one thing that should be made abundantly clear:

Paying Interest on Credit Cards is Enemy #1

Money paid in credit card interest is money wasted – plain and simple. It can be a hole that’s hard to dig out of, but you need to start somewhere. Most of my users have some kind of credit card debt that they are working on paying down. Here are two quick and easy things that I recommend doing right now:

- Call your credit card company and ask nicely for a lower rate. This is a surprisingly effective tactic and is easily worth five minutes of your time. Remember, lenders are motivated to keep you as a customer.

- Apply for a 0% balance transfer promotion. No-interest promos can really help you jump start your payoff plan. They are typically good for 12-18 months and have a fee of 2-5%. Be sure that it’s a no fee card and also do the math to make sure you will come out ahead. 5% is on the high side so do some comparisons before you start applying. Discover & Chase Slate are two good ones to start with because they usually have good approval odds. Discover Cards are a good place to start with balance transfers. Sock drawer the card and don’t make any more purchases with the card. Keep aggressively paying down debt. It’s ok if the promo expires, you won’t get hit with accrued interest like you would if the account of the deferred interest variety.

Eliminate Debt Interest Using the Credit Card Tag Team

Here’s a strategy that I used to get myself out of credit card debt that worked very well for me. I alternated balance transfers between a few different credit cards so I paid 0% interest on almost all of my revolving debt. A couple of years ago I took advantage of a Discover balance transfer promo that only charged a 2% balance transfer fee. I was able to consolidate a few different higher interest accounts into one and was still able to aggressively pay down debt. When the promo expired a year later, I moved the remaining debt from Discover over to two different Chase cards (Slate & Amazon). The Chase balance transfer was at a higher rate (5%), but it still works out much better in the long run. Another thing to keep in mind is that you can’t do balance transfers directly between Chase cards so you need a team of credit cards working for you.

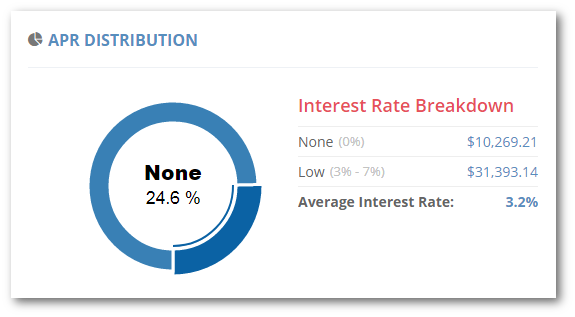

Using 0% balance transfers and very low interest loans gets me a very respectable overall interest rate of 3.2%. This APR distribution graph can be found on the Credit Utilization page of your Undebt.it account. It’s part of the free user plan, so all users have access to this page.

When I first started my payoff plan, I was paying close to $400/month in interest alone (not including any mortgage interest). Now, I’m paying just over $0 in credit card interest and using that money to pay down other debts.

Buy Everything Using a Credit Card

This sounds like bad advice, especially from the developer of a debt management tool, but hear me out. You can get some major benefits if you do it right. If you can get a separate credit card (have dedicated cards for balance transfers) for ongoing purchases (groceries, utilities, etc.), you can start getting ahead in the credit game. Purchase discipline is key because if you start carrying a balance for ongoing purchases, you have lost the credit game. Here’s what I mean by purchase discipline:

- Only make purchases you would have normally made anyways using a debit card or check. It’s too easy to buy things you don’t need with money that you don’t have when it doesn’t come out of your checking account right away.

- Always pay off the purchase quickly. I like to pay off the purchases as soon as they post so they don’t keep accumulating. It’s also easier for me to reconcile my budget when there are multiple transactions throughout the month instead of one or two large payments. Be especially careful around the statement closing time because any open balances will show on your credit report and can cause a brief drop in your score.

Credit Card Benefits

Now that the warnings are out of the way, there are plenty of benefits to using credit for purchases:

- Rewards: You can get a cash back or points that can be used for travel and other expenses. These rewards can add up quick and it’s free money. I don’t like leaving free money on the table. It’s best to decide early on which of these your prefer because it will affect which credit cards you will want to apply for.

- Fraud & purchase protection: Credit cards offer some protection against card theft and illegal use that debit cards don’t offer. Disputes can easily be initiated on fraudulent transactions.

- Other benefits: Most cards offer some kind of other benefits, like extended warranties, price matching and theft protection. Some even offer cell phone loss & damage protection.

When I was at this point last year, I was getting around $75/month back in cash rewards and also earning around $500/year in Costco credit. These are the two cards I used at the time:

Citi Costco (Visa)

This is a no-fee credit card that is a great choice if you just want to use a single card. It has great benefits, especially for a no-fee card. It doesn’t use rotating benefit categories like most other cards, which means that you don’t have to remember what is active and there’s also no need to activate promotions like Discover and Chase Freedom. Here is how the cash back categories are setup:

- 4% cash back rewards on eligible gas worldwide, including gas at Costco, for the first $7,000 per year and then 1% thereafter

- 3% cash back rewards on restaurant and eligible travel purchases worldwide

- 2% cash back rewards on all other purchases from Costco and Costco.com

- 1% cash back rewards on all other purchases

The ones that get my attention the most are the 4% off of gas and the 3% cash back on restaurants and travel. If you have an Executive Costco membership, you are getting 4% cash back on your purchases every year. I buy a lot of stuff at Costco so that made it a no-brainer to pick up this card. The list other benefits is long, but here are some of the standouts: extended warranty, Citi Price Rewind (price matching) and damage & theft protection up to $1,000 per item.

One thing to keep in mind about the cash back is that it is only distributed once a year. It comes as a credit certificate that can be used or cashed only at Costco. Sometimes the Chase Freedom card has a 5% quarterly bonus for warehouse clubs, so keep an eye out.

Citi Double Cashback (Mastercard)

Here’s a no-fee, easy to get credit that gets you 2% cash back on all purchases. There are no rotating categories to deal with and the Citi DC has the same benefits as the Citi Costco card listed above in addition to virtual account numbers which I think is a nice feature. It’s a great general use card and the cashback can be redeemed whenever you reach the $25 minimum. This is the one I used to pay most of the bills and on things like groceries.

One thing that I like about the Citi ecosystem is that your balance gets adjusted immediately whenever you make an online payment. None of the other banks that I use do this and it’s nice to see what your actual balance is rather than waiting a couple of days for the transaction to post.

Advanced Mode

This is where the real fun starts. When you get all of your credit card debt paid off, you can really reap the benefits of your labor. By the time you get here, you will have a 0% revolving credit utilization and a high credit score along with an extensive credit history. With these tools in your pocket, you can start opening up new, high-end cards that offer huge sign up bonuses and really rack up the rewards. Some of these cards have a high annual fee, but it can be easily offset by the bonuses.

There is a lot of planning that needs to go into place to really make this work. There are a ton of other resources out there so I won’t rehash a lot of it, but here are the basics of credit card churning:

- Decide early on what your priorities are. Some people like cashback bonuses while others like travel/hotel rewards. Chase Ultimate Rewards (UR) and Amex Membership Rewards (MR) are the main travel rewards players but there are others too.

- Chase will deny you if you have 5 or more credit cards opened in the last rolling 24 months. Use Credit Karma to get an idea of your card count. It’s a good idea to start with Chase cards since other brands are not as sensitive to the number of open accounts. It’s an even better idea to start with Chase business cards since they don’t apply to the Chase 5/24 rule. As an added bonus, business cards don’t show up on your personal credit report.

- Amex cards are easy to get, but save them for when you are done with Chase. There are also additional sign-up bonuses you can get by using a referral so look around first.

- Do your homework before you start applying for cards. Churning credit is outside the scope of this site, but I can point you in the right direction so feel free to use the contact form to ask questions.

Do you have a promo code for undebit + going on right now? I can only find the one for the end of 2018. I’m in my 30 day trial and want to extend 🙂

The promo code FBFRIENDS is still good for 25% off.

Very intresting tips, I am still on my path to clear all my debt. however i would be afraid to take advantage of credits cards once im done. I think i would stick to 1 card only haha

It does require some discipline, but can be lucrative in the long run.