How to Make Multiple Payments on an Account

Background on Multiple Payments

In this article, I am going to go over how to deal with multiple payments on the same debt account on Undebt.it. In it’s simplest form, Undebt.it’s main purpose is to tell you how much you need to pay on each of your debt accounts to effectively eliminate them. However, sometimes it’s not as easy to pay a certain amount towards a debt once a month and you need a little more flexibility. Undebt.it supports unlimited payment and purchase transactions, so I’m going to show you how the system works when you want pay more than once a month towards an account.

The Due Date Problem

Undebt.it relies heavily on the Next Due Date of debt accounts and how it builds the payment schedule. If the due date of an account is set to a date on the next calendar month, then the site will not be including that debt in the payoff plan because it thinks there is nothing left to pay.

The Monthly Payment is also a key factor in the payment plan. Whenever you record a payment transaction that’s the same or higher as the Monthly Payment, the site will bump up the Next Due Date to next month. I set it up this way because this is the way most people pay off their debt and I wanted to make it so you wouldn’t have to always be manually adjusting the due dates on your accounts.

The Car Loan Example

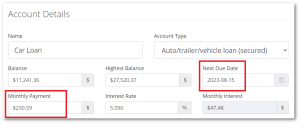

In this example, I’m going to making multiple payments on a car loan which happens to be #1 on the payoff order (meaning that all of the debt snowball amount will be applied to it). The total monthly budget for all accounts is $800 and the snowball amount is $194.41. The Monthly Payment on the car loan is $230.59 and it’s due by the 19th of the month. Here’s how the account looks on the Undebt.it Dashboard:

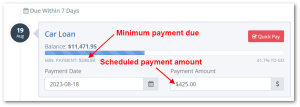

We know we absolutely have to pay the $230.59 on or before the 19th of the month so that’s not a problem. For the sake of the example, let’s say that I’m not sure if I can pay any extra debt snowball amount this month so for now, I am just going to make the required payment. In the screenshot you can see that the schedule payment amount (this is the amount that you will see on the Snowball Table page) is $425. You don’t always have to make the full payment that’s in the box. I’m going to change it to the minimum amount due, $230.59 and then click on the Quick Pay button to save the payment info.

Making the Necessary Adjustments

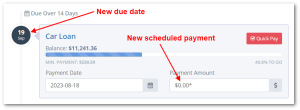

The problem we see now is that the site thinks you are done with this debt account for the month and is going to apply the snowball amount to another account that’s due this month. Here’s how the account now looks on the Dashboard page:

Notice how the next due date is now set to next month. The scheduled payment amount is now zero. Note that the asterisk you see next to $0 means that at least one payment has been made on the account this calendar month.

On the Snowball Table page, you can see the $230.59 payment made (the blue color means the payment was made for this current calendar month). We need to make some manual adjustments to fix the problem, so click on the account name, Car Loan, in this example, to get to the Debt Details page. All we need to do is change the Next Due Date back to the original date, 8-19 in this case. Go back to the Snowball Table page to see what’s changed.

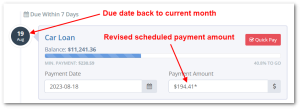

Now we see the Car Loan is back in August and has a new scheduled payment of $194.41. The snowball amount has moved back to this account since it’s now still active for the month. The $230.59 is still there in blue. Now let’s head back to Dashboard page to see what it looks like.

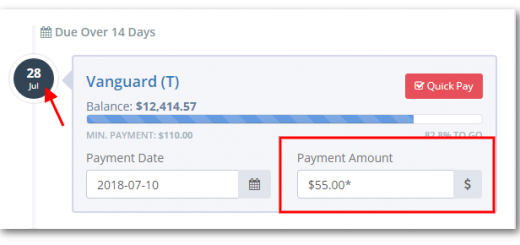

The Next Due Date is now back in the current month and the revised scheduled payment amount is now showing our snowball amount of $194.41. Remember, the asterisk just means that at least one payment has already been made on the account. Now I can take my time and make any additional payments towards the loan if the cash flow improves.

Wrapping Up

This is just one example on how you can make Undebt.it work to meet your specific requirements. The car loan example is just one simple example, but the same method can apply to other scenarios like bi-monthly mortgages, 401k loans, weekly payments and so on. It may take a little work, but it’s worth it to stay 100% on track with your debt payoff plan.