Dealing with Weekly or Bi-Weekly Payments

Monthly vs. Weekly Accounts

Not all of your debts have a simple “due date” associated with them. Bi-weekly or bi-monthly payments, for example, can be difficult to track without a little manual intervention. This post details how I handle my bi-weekly 401k loan. I get paid every other week and the payment is automatically taken out of my check. I’m not concerned as much with “due dates” because the payment is automatic and there is no way for it to be late.

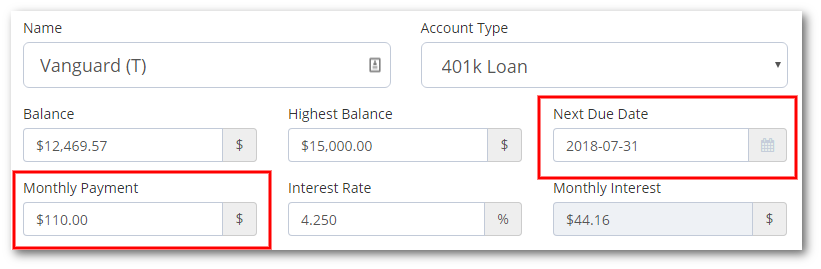

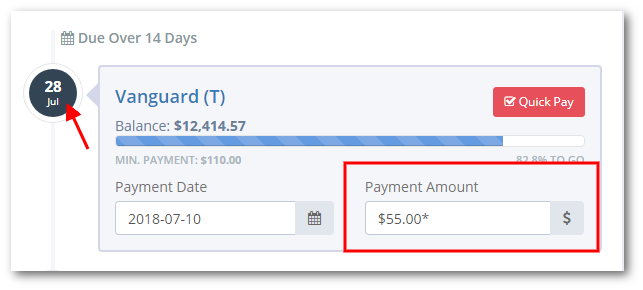

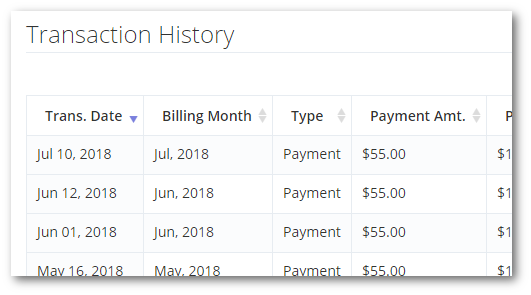

The terms of the loan are for monthly installments of approximately $110. Since I get paid every other week, each check gets $55 deducted. I set the due date of the loan to be the last day of the current month, although you could choose the date of your last paycheck of the month if you wanted to. Then I set the monthly payment to $110. Lastly, each time I get paid during the month, I just enter a $55 payment for the month. Since the payment is less than the minimum monthly payment, your “next due date” should not get bumped up to the next month. Remember, you can have multiple payments for a billing month. After the last paycheck of the month, you may have to manually adjust your “next due date” to the next month.

The screen above shows how the account looks on the Debt Dashboard after one of the two payments has been recorded. Note the asterisk next to the amount in the “payment amount” field; this tells you that one or more payments has already been made and this is your scheduled remaining amount due. Also notice that the due date has not changed from the end of the current month.

Bonus Payments

Of course if you get paid bi-weekly, then you’ll have an extra two loan payments each year. I don’t bother adjusting the minimum payment for the debt for the month, I just add the payment normally and not worry about it.

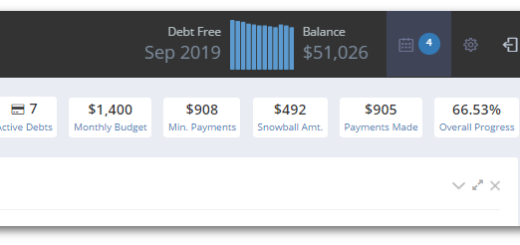

This setup makes the Payment Manager on the Debt Dashboard look nice and clean. If you do it this way, these debt payments should never show “in the red” as being late.

I really like the features of the tool. However, I would really like to see an option for bi-weekly payroll and payments incorporated site wide. This is a very common form of payroll payment. As such, many people like myself setup their bills to be paid on a bi-weekly schedule. For a snowball calculator, this should be a crucial feature as sticking to a bi-weekly payment schedule results in greatly reduced repayment terms and interest. As matter of fact, you should be encouraging people to pay bi-weekly as it makes one full extra payment per year without even thinking about it.

Trying to work around monthly payments just doesn’t work as well and doesn’t give an accurate reflection of what is actually occurring. Add that extra feature and I am a paying customer.

How do you envision this working? Would you have “pay period #1,2,3” buckets instead of “week 1,2,3”?

Not sure I follow the “pay period” vs “monthly buckets”. Currently, everything is configured and displayed on a “monthly basis”.

I’d think the easiest way would be to have an option in the dashboard “Payoff Method” for bi-weekly. For that setting, have all the computations and results configured for every two weeks instead of monthly. All data inputs for budget, snowball and minimum payments would be entered for bi-week amount instead of monthly amount.

Obviously not perfect because some bills will not allow biweekly payments, but it would automatically capture the extra payment made each year.

Ultimately, I believe people likely set their payments and pay bills based on the type of payroll period they are on. Some are monthly payroll while others are twice monthly or bi-weekly. If users could choose the type of periods they receive payroll it would give the user a more accurate plan to work with.

With all that said, thank you for the great tool you’ve developed. It is obvious a lot of time and work went into the product. Thanks for the opportunity to make suggestions.

I agree with Tim. I get paid every two weeks and have to continuously make adjustments. I appreciate your site. I just signed on. Thank you!

I agree with @Tim

Using a monthly payment for mortgages also makes a huge difference in interest paid. Can there not be an option for payment frequency?

No, not anytime soon

So using your suggestion: I get paid on the 15th and 31st of each month and I pay my car payments on the 1st and 15th of each month just to break it up between two checks. I don’t get the advantage of an extra payment this way it just works to take the burden away from one check. Would I just say the payment is due on the 15th of each month for the total amount and just record the half payment on the first?

I would keep it due on the 15th. I assume the first payment is not more than the minimum amount; if it is more, you’ll have to adjust the due date back to the current month.

New user today – great site and cool tools! But this was my first question – handling bi-weekly compensation for bills.

The bi-weekly option is a development nightmare, since most bills are typically paid monthly, but cashflow would be every 28 days. It’s not insurmountable, however.

For income:

Rule 1: Payday frequency weekly, bi-weekly, twice-monthly, monthly

Rule 2: Date of next payday (needed to guide the calendar)

Rule 3: Amount per payday allocated toward debt

Then, the calculation of available amount handles itself. If you’re monthly – same as today. If twice-monthly, multiply value *2 and convert to a monthly number. If bi-weekly, figure out whether this month has two or three paydays (calculated from payday) and multiply value by that number to populate the amount (which could change by month). If weekly, handle the same as bi-weekly except you’ll first determine whether this month has four or five paydays. That makes sure the amount calculated is the right one for me to budget/snowball.

As for advancing payment dates on specific debts, you could add a rule to denote whether the bill is paid monthly (current functionality) or bi-weekly (default to monthly) when creating the bill. If set to bi-weekly, advance the date by 28 days. A final rule could be on each debt, or at the Payoff Plan level, to outline what should be done the next payment month is ahead of the Payoff Plan month. For instance, if because of bi-weekly payments I’m now a month ahead on my mortgage (due May 1), in April I might want to (1) Make the normal payment (current functionality), (2) pay the entire amount as principal to my mortgage (in essence, an automatic snowball to my mortgage), or (3) allow undebt.it to use that amount to follow the payoff plan.

While I’d love this as part of the base offering, this could easily be wrapped into your premium service. I’d probably pay for it!

This is really cool software. I’ve built a spreadsheet to handle this, but it’s somewhat brittle. Your UI is clean, and the reporting is helpful. Congratulations and Thanks!

I know I’d pay for the premium membership if I could factor in my biweekly payment frequency vs my monthly bills. Right now, I down load the free excell version and work from it. This is very time consuming for me, so I would happily pay a premium to have this solved. Having written that, I love your basic service and I refer you a lot.

A bi-weekly option would be a game changer for me too. I love the program so much that I did pay for it but it was too much effort to keep up with as biweekly entries. Also, would love to see an auto-payment indicator so I do not have to enter scheduled payments.

I also agree with the bi-weekly payments option. It would be so helpful! Thanks.