The Credit Score Jumpstart Project

Why Does My Credit Score Need a Jumpstart?

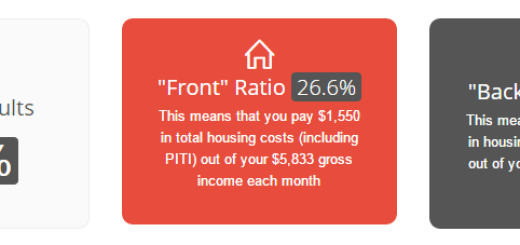

My wife and I have been renting a house for the last couple of years now and with the current state of the central California housing market, thought it might be a good idea to look into becoming homeowners again in the near future. It looks like the bottom has been reached and home prices are projected to increase over the next year. I’ve been steadily chipping away at our substantial debt for over three years now and the end is in sight, but still a ways off. If I stayed on course with the current payment plan, it would be a couple of years before our credit was in good shape again.  Knowing that we may be in the market for a house soon and in turn, a mortgage, I decided to take a more aggressive approach to improving our credit score quickly by taking out a 401k loan to payoff certain debts out of order of my snowball plan. This will give us more options and flexibility if the right situation presents itself. I was also curious how long it took debt payoffs to be reflected on your credit score and the benefit of paying off certain accounts and decided to document the process. I’m assuming that the credit info will be reported to the bureaus shortly (a day or two?) after each accounts’ billing cycle. I just missed the close of the current billing cycle by a dew days, so I’ll likely have to wait about a month to see any real activity.

Knowing that we may be in the market for a house soon and in turn, a mortgage, I decided to take a more aggressive approach to improving our credit score quickly by taking out a 401k loan to payoff certain debts out of order of my snowball plan. This will give us more options and flexibility if the right situation presents itself. I was also curious how long it took debt payoffs to be reflected on your credit score and the benefit of paying off certain accounts and decided to document the process. I’m assuming that the credit info will be reported to the bureaus shortly (a day or two?) after each accounts’ billing cycle. I just missed the close of the current billing cycle by a dew days, so I’ll likely have to wait about a month to see any real activity.

Know Your Score

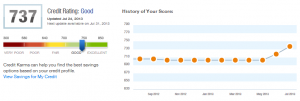

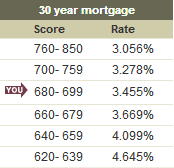

The easiest way to get an idea of what your credit score is to try out Credit Karma (free). It uses your Transunion credit report to generate two of its own proprietary credit scores which should give you are pretty good idea of your actual FICO score.  The first Credit Karma score, the “Transunion New Account Score” (ranges 300 – 850), has been holding steady 703 for the last eight months now. 703 is classified as “Good”, but just barely. It looks like anything south of 700 is considered “Fair”. The other Credit Karma score, the “Vantage Score” (ranges 501 – 990) shows some more action – changing at least a little every month. At the time of this writing, it was 696, a solid “D”, very close to the 700 cut off for “C” range. Lastly, I wanted to see what my actual FICO score was before I paid off these accounts so I signed up with MyFico.com (paid) for a 3 month stint of $15/month. As of 4/30/2013 my Equifax FICO score was 696 – Ok, but definitely not great. This will put me at a higher mortgage interest rate than if I was to get over my goal of 720.

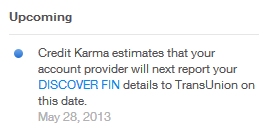

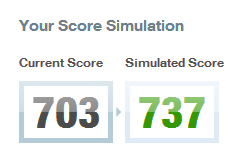

The first Credit Karma score, the “Transunion New Account Score” (ranges 300 – 850), has been holding steady 703 for the last eight months now. 703 is classified as “Good”, but just barely. It looks like anything south of 700 is considered “Fair”. The other Credit Karma score, the “Vantage Score” (ranges 501 – 990) shows some more action – changing at least a little every month. At the time of this writing, it was 696, a solid “D”, very close to the 700 cut off for “C” range. Lastly, I wanted to see what my actual FICO score was before I paid off these accounts so I signed up with MyFico.com (paid) for a 3 month stint of $15/month. As of 4/30/2013 my Equifax FICO score was 696 – Ok, but definitely not great. This will put me at a higher mortgage interest rate than if I was to get over my goal of 720.  Another nice thing I found buried in Credit Karma is the “upcoming” section (located in the “alerts” area). It tells you when each account will probably update to your report based on the history. You can also do a credit simulation on different scenarios. I chose the “payoff all credit card” option and it projected a Credit Karma score of 737 – we’ll see how accurate this will be shortly.

Another nice thing I found buried in Credit Karma is the “upcoming” section (located in the “alerts” area). It tells you when each account will probably update to your report based on the history. You can also do a credit simulation on different scenarios. I chose the “payoff all credit card” option and it projected a Credit Karma score of 737 – we’ll see how accurate this will be shortly.

Another feature of Credit Karma is the ability to connect your credit report accounts to your actual accounts (by supplying them with your user name and password). This would presumably mean faster and more accurate updates. I chose to not do this because I wanted to see how long the updates took to propagate on their own.

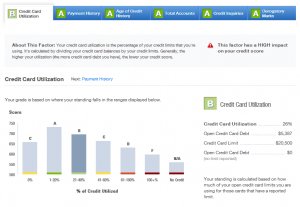

Credit Utilization Problems

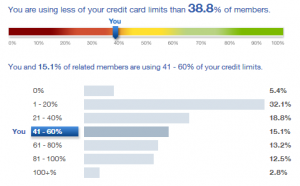

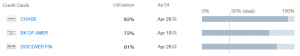

One of the biggest problems with my credit is the extremely high credit utilization rate – a whopping 82% on revolving debt. Ideally, the range is between 0 – 30% depending on who you talk to. To make the problem worse, banks can arbitrarily cut your credit limit, which is what happened to with my account with Chase.  It went from a credit limit of $8,900 down to $6,600 (on a balance of approx. $6,000) without warning and increased my credit utilization percentage by a full 10 points. My plan will bring this number down to a much more attractive utilization rate of 29.7%. On a side note, I use the free “Check” app (formerly Pageonce) and was notified of the decrease by them a full day or two before being sent anything by Chase.

It went from a credit limit of $8,900 down to $6,600 (on a balance of approx. $6,000) without warning and increased my credit utilization percentage by a full 10 points. My plan will bring this number down to a much more attractive utilization rate of 29.7%. On a side note, I use the free “Check” app (formerly Pageonce) and was notified of the decrease by them a full day or two before being sent anything by Chase.

Let’s Get the Ball Rolling!

The process of getting a 401k loan is surprisingly easy and only took about a week to get the funding right into our checking account. I’ll do another post on that process, including the math and risk factors, in the near future. We ended up with about $17,500 and were able to start paying off debts on 4/29. The following is a timeline which I will update as needed:

- 4/10 – Chase cuts credit line from $8,900 to $6,600

- 4/29 – Funding received, payments made to Discover, Chase and two credit union accounts

- 4/30 – Signed up with MyFICO to check my score: 696

- 5/1 – Discover increased credit line by $1,000

- 5/2 – MyFICO credit alert on Chase for a balance increase. It was from a $200 charge on 4/8. FICO score still the same

- 5/3 – Credit Karma update (they update every Friday, apparently). Vanatagescore 696 “D”, Transunion score 703 “Good”. Chase credit drop shows in activity section.

- 5/10 – Credit Karma update. Vantagescore up to 699, Transunion stays the same

- 5/14 – FICO score still 696. MyFICO allows you to do one additional score check every month. I chose to run it about half way through the month to see if anything new showed up. Note: I misread the twice a month check, it’s really two FICO score checks a year so I screwed up on that one.

*May 17 Update*

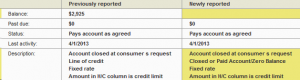

I received a MyFICO alert today that my score had changed so I logged in and checked it out. What I found was a little surprising, my FICO score had dropped from 696 to 693. It turns out that one of the paid off loans had caused the change.  This was an odd loan to begin with, it was a line of credit loan from a credit union that had been “closed” out by the bank – meaning there was no credit available but I have been “paying as agreed” so it’s been open on my credit report. It had a high interest rate and a high minimum payment, so that’s why I paid it off. There are two changes highlighted by MyFICO, the balance and the description. The balance is empty, not $0 like I’d expect – maybe it will update next month? The description is now slightly different too – another reference about being closed. What probably happened is that now that the loan is paid off, the credit union closed it out and my credit took a minor hit because it was an old account, open since ’97.

This was an odd loan to begin with, it was a line of credit loan from a credit union that had been “closed” out by the bank – meaning there was no credit available but I have been “paying as agreed” so it’s been open on my credit report. It had a high interest rate and a high minimum payment, so that’s why I paid it off. There are two changes highlighted by MyFICO, the balance and the description. The balance is empty, not $0 like I’d expect – maybe it will update next month? The description is now slightly different too – another reference about being closed. What probably happened is that now that the loan is paid off, the credit union closed it out and my credit took a minor hit because it was an old account, open since ’97.

*May 30 Update*

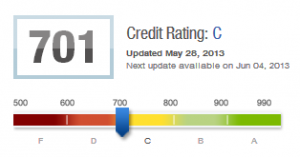

The credit card billing cycles have now been finished. I’m still seeing the old balances in Credit Karma. A couple of new things did pop up though: Firstly, my Vantage score went from a 696 “D” to a 701 “C”. Secondly, the Credit Karma update date shifted from Fridays to Tuesdays. I’m not sure what the cause of the improvement to the score would be since the old balances are still showing. What it probably was is that the Bank of America balance is showing the current amount. The last payment I made took the utilization from 73% down to 65%. Still no updates from MyFICO.

I’m not sure what the cause of the improvement to the score would be since the old balances are still showing. What it probably was is that the Bank of America balance is showing the current amount. The last payment I made took the utilization from 73% down to 65%. Still no updates from MyFICO.

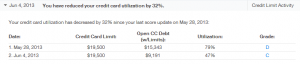

*June 4 Update*

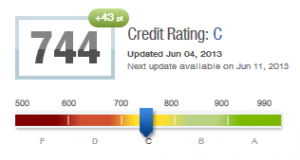

Finally starting seeing some progress today – the Chase credit card payoff is now showing in Credit Karma.

This reflects the $6,100 payment that was made on 4-29. My Transunion score took a 15 point bump from 703 up to 718 while the Vantagescore increased 43 points – from 701 to 744. Note that just the one credit card payment has made it through to Credit Karma, my Discover payment of around $3,900. My credit card utilization is now showing 47%. Interestingly, no updates from MyFICO.com.

This reflects the $6,100 payment that was made on 4-29. My Transunion score took a 15 point bump from 703 up to 718 while the Vantagescore increased 43 points – from 701 to 744. Note that just the one credit card payment has made it through to Credit Karma, my Discover payment of around $3,900. My credit card utilization is now showing 47%. Interestingly, no updates from MyFICO.com.

*June 11 Update*

Credit Karma updated today – nothing new though. Discover is still showing a $4,000 balance. It should have updated by late May, not sure what’s going on there.

*June 18 Update*

Credit Karma updated today – again, nothing new. Scores are the same. Discover is still showing a balance on the account. I’m guessing it’s an issue with Discover because I have not had a myFICO balance change alert on the Discover account.

*June 21 Update*

I received a MyFICO credit alert today that my score had gone up – it’s now up from 693 to 696. The payments made to Discover and Chase still have shown up on MyFICO. The reason for the change was just the natural decrease in balances from other accounts being paid down.

*June 30 Update*

Another MyFICO update today. My FICO score is up from 696 to 706. All the big transactions have flowed through to my credit report so this is probably the ceiling for this little project. I was hoping for something closer to 720, but at least the threshold of 700 was crossed.

*July 1 Update*

Yet another MyFICO mini update. I had a small $3 balance on one of the big credit cards from some accrued interest. The report shows a zero dollar balance and that bought me an extra point – from 706 to 707.

*July 2 Update*

Credit Karma reported the payment to Discover, a decrease in balance of $3,692. It also reported the old credit line increase of $1,000 on the Discover card for some reason. TransUnion credit score is now 737 “Good”, which happens to exactly match their estimated score from the payment simulator at the top of this article. Vantagescore is now at 769 “C”.

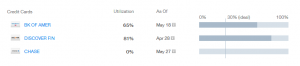

*July 24 Update*

Here’s how my Credit Karma profile is looking after all of the dust has settled. My credit utilization is sitting nicely under 30% at 26%.