New Debt Planner Page Available

Debt Planner Introduction

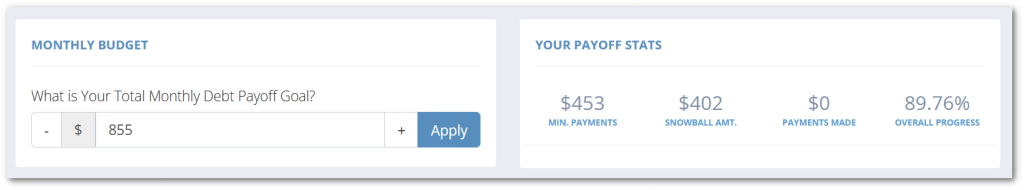

Monthly Budget & Stats

The first section shows your total monthly debt payment budget amount. You can change the budget amount here here if you like. The second tile shows some other basic stats; total minimum payment amount of your active accounts, total snowball amount, payments made for the current month and lastly, total debt payoff progress in a percentage.

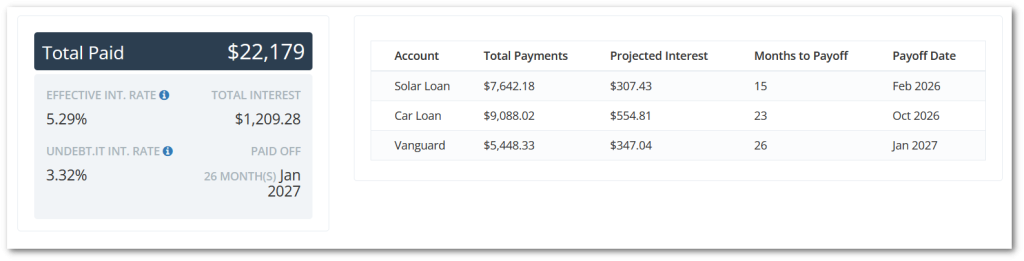

The Debt Summary Section

The summary section shows the total amount you’ll be paying on each debt if you stick to the payoff plan. Also shown is the total interest paid and projected payoff date. There are some new and tweaked interest rate numbers you’ll notice in the summary section:

- Effective Interest Rate: To calculate the overall effective interest rate on multiple accounts, we need to find the weighted average interest rate. This is done by multiplying each account’s balance by its interest rate, summing these products, and then dividing by the total balance of all accounts. Keep in mind, this does not account for the accelerated debt snowball payoff schedule. This is purely the current effective interest rate on your active debt accounts at this point in time.

- Undebt.it Interest Rate: This calculation is similar to the effective interest rate, but it does account for accelerated debt snowball payoff schedule. The weighted interest rate is calculated based on the projected months to payoff and the projected interest that will be paid on the account.

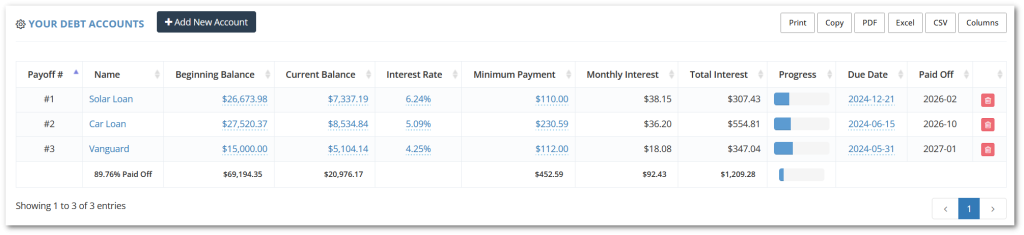

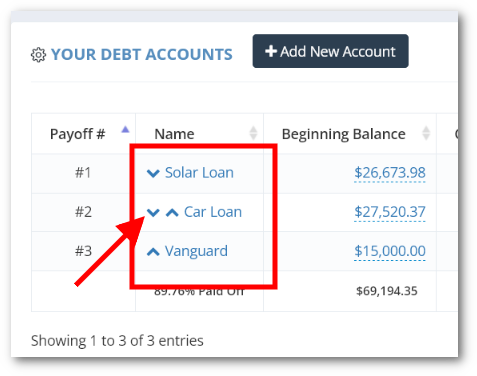

Debt Account Setup

The third section shows a list of your active debt accounts. The text with an underline are fields you can edit right from this page: beginning balance, current balance, interest rate, minimum monthly payment and next due date. You can also export the account list to a PDF or CSV file or send it to your printer. Click on the “Add New Account” button to create a new debt account.

Changing Your Custom Debt Payoff Plan Sort Order

My favorite part of the debt account setup section is the custom payoff order quick changer. If you use the custom debt payoff method, you’ll see order change up and down arrows that let you easily move the payoff order around quickly. The arrows will only show up if you are currently using the custom order payoff method.

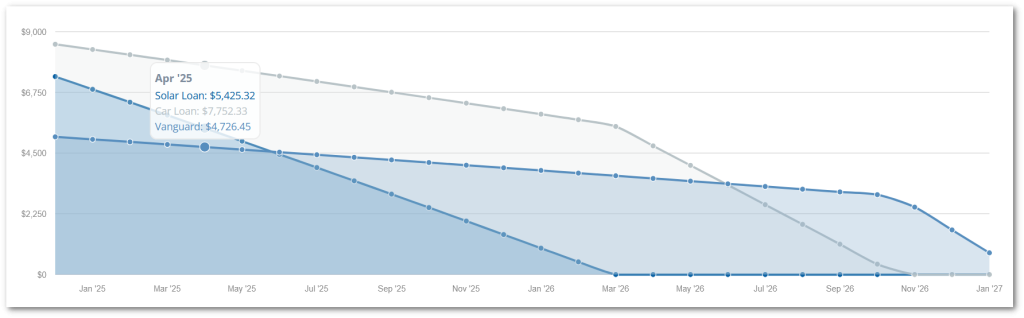

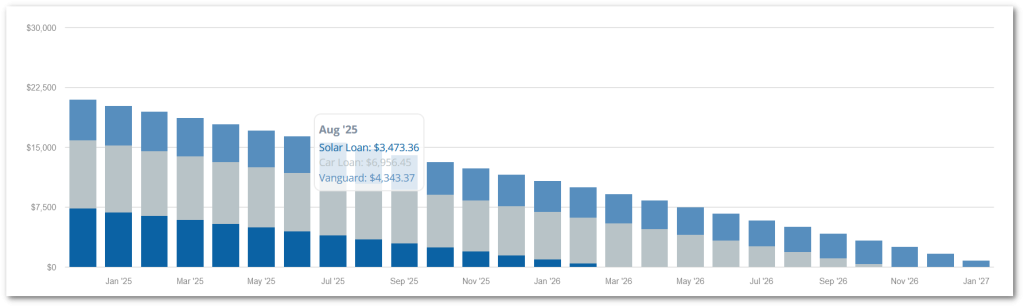

Projected Debt Payoff Charts

The last section shows two different debt payoff charts. The first chart is an area chart that shows the progress of debt payoff over time. The second one is a stacked bar chart that shows you how the proportionate account balances change over time. You can hover over the chart to see the account details for each month.

Conclusion

This new page is meant to compliment the other pages on the site, not replace them. This page is designed for planning and seeing how much interest you are planning on paying. The other pages, like the Dashboard, are meant for day-to-day account maintenance like adding payment information. I’ll make the Debt Planner available as a landing page option (which can be set on the Account Options page) . This Hope you like the Debt Planner!